ATAL PENSION YOJANA TERMS & CONDITIONS

Details of the Scheme

Atal Pension Yojana (APY), a pension scheme for citizens of India focused on the unorganized sector workers.

Under

the APY, guaranteed minimum pension of Rs. 1,000/-, 2,000/-, 3,000/-, 4,000 and 5,000/- per month will be given

at

the age of 60 years depending on the contributions by the subscribers.

The scheme is administered by the Pension Fund Regulatory and Development Authority (PFRDA) through NPS

architecture

specifically focused on all citizens in the unorganized sector. On successful registration into the scheme, a

PRAN

(Permanent Retirement Account Number) will be allotted to the subscriber. Customer can download his / her Atal

Pension

Yojana statement based on this unique number, PRAN, that identifies his/her account.

Government co-contribution is available for 5 years, i.e., from 2015-16 to 2019- 20 for the subscribers who

join the

scheme during the period from 1st June, 2015 to 31st December, 2015 and who are not covered by any Statutory

Social

Security Schemes and are not income tax payers. The Government co-contribution is payable to eligible PRANs by

PFRDA

after receiving the confirmation from Central Record Keeping Agency once in a year. Government contribution will

be credited in subscriber’s Savings Bank account.

Beneficiaries who are covered under statutory social security schemes are not eligible to receive Government

co-contribution.

For example, members of the Social Security Schemes under the following enactments would not be eligible to

receive

Government co-contribution:

- Employees’ Provident Fund & Miscellaneous Provision Act, 1952.

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948.

- Assam Tea Plantation Provident Fund and Miscellaneous Provision, 1955.

- Seamens’ Provident Fund Act, 1966.

- Jammu Kashmir Employees’ Provident Fund & Miscellaneous Provision Act, 1961.

- Any other statutory social security scheme.

The subscribers can opt to decrease or increase pension amount during the course of accumulation phase, as per

the

available monthly pension amounts. However, the switching option shall be provided once in year as indicated by

PFRDA.

The subscriber will receive periodic physical Statement of Account issued by NSDL once a year. Additionally,

subscriber

can download APY app to view account details / contributions paid / transaction statement. Alternatively, you

can

also download your APY account statement, please

click here

Steps to be followed for downloading the APY account statement –

- Enter Name + Bank a/c No. + DOB & Print

OR

- Enter PRAN* + Bank a/c Number & Print

*PRAN is available in the APY contribution debit narration in

your account (PRAN begins with “5” & is 12 digit)

If subscriber is married then spouse by default will be nominee in this scheme. The subscriber can provide

additional

nominee.

The subscriber is advised to share mobile number details with the bank during enrolment to receive

registration & contribution

confirmation from NSDL.

Atal Pension Yojana (APY) Subscribers have an option to opt for physical PRAN Card by accessing eNPS portal.

An instruction Link has been provided to Subscribers to know how to Print APY PRAN Card. This link is available

once Subscriber clicks on Atal Pension Yojana menu available on eNPS portal. Link to Print APY PRAN Card – Click here

Eligibility

Atal Pension Yojana (APY) is open to all saving bank account holders. The minimum age for joining APY is 18

years and

maximum age is less than 40 years. Therefore, minimum period of contribution by any subscriber under APY would

be

20 years or more. The subscriber should not be holding any other APY account while applying from Airtel Payments

Bank.

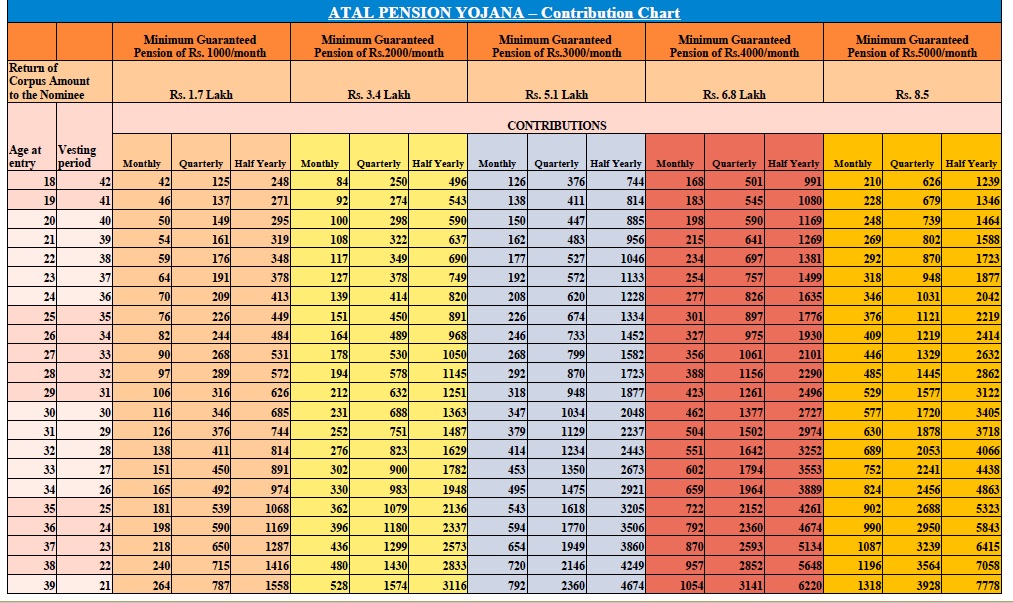

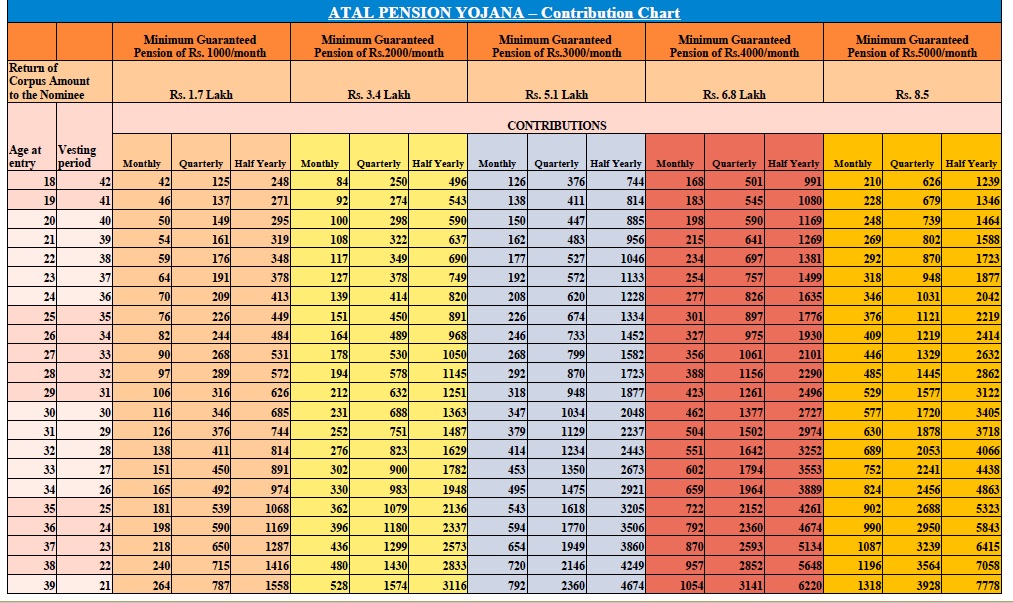

Contributions

Contribution will be deducted from the customer’s saving bank account on an auto-debit basis. The demographic

data

of the customer will be taken from core banking. Thus the contribution will be deducted as per date of birth of

the

customer in core banking.

The contributions can be made at monthly / quarterly / half yearly intervals from savings bank account of the

subscriber.

First contribution will be debited at the time of enrollment; subsequent contribution will be debited on 15th of

every month or any other date of the month as per the frequency chosen by the subscriber. The quarterly and

half-yearly

contributions will happen in the first month of the financial year quarter/half year.

The subscribers are advised to keep required balance in their savings bank accounts to avoid any late payment

penalty.

Table for contribution

Benefits

The contributions under APY are invested as per the investment guidelines prescribed by Ministry of Finance,

Government

of India.

Under APY, the monthly pension would be available to the subscriber in the associated bank account registered

with

NSDL, and after him to his spouse and after their death, the pension corpus, would be returned to the nominee of

the subscriber.

The Government co-contribution is payable to eligible PRANs by PFRDA after receiving the confirmation from

Central

Record Keeping Agency once in a year. Government contribution will be credited in subscriber’s Savings Bank

account.

Also any false declaration about his/her eligibility for benefits under this scheme for whatsoever reason, the

entire

government contribution shall be forfeited along with the penal interest.

Contributions under the pension scheme enjoy the same tax benefits as the NPS (National Pension System).

Contributions

can be claimed under Section 80CCD (1B) of the Income Tax Act. The current limit for income tax deduction

Section

80CCD (1B) is Rs. 50,000. This is over and above the Rs. 1.5 lakh allowed under Section 80C.

Penalty for default

Under APY, the individual subscribers shall have an option to make the contribution on a

monthly/quarterly/half-yearly

basis. The monthly/quarterly/half-yearly contribution will be debited on 15th of every month/ 15th of first

month

of quarter/15th of first month of half year from the savings bank account. If there is a delayed payment then it

will be treated as a default and contribution will have to be paid in the subsequent month along with overdue

interest

for delayed contributions. The fixed amount of interest/penalty will remain as part of the pension corpus of the

subscriber. Airtel Payments Bank shall collect additional amount for delayed payments. The penalty charged will

be

Re. 1 per Rs. 100 contribution amount. The below chart is an example of overdue interest collected.

Overdue interest chart

| Sr. No |

Contribution Amount Range (Rs) |

Overdue Interest to be paid per month (Rs) |

| 1 |

1-100 |

1 |

| 2 |

101-200 |

2 |

| 3 |

201-300 |

3 |

| 4 |

301-400 |

4 |

| 5 |

401-500 |

5 |

| 6 |

501-600 |

6 |

| 7 |

601-700 |

7 |

| 8 |

701-800 |

8 |

| 9 |

801-900 |

9 |

| 10 |

901-1000 |

10 |

| 11 |

1001-1100 |

11 |

| 12 |

1101-1200 |

12 |

| 13 |

1201-1300 |

13 |

| 14 |

1301-1400 |

14 |

More than one monthly / quarterly / half yearly contribution can be recovered subject to availability of the

funds. In all

cases, the contribution is to be recovered along with the overdue charges if any. The due amount will be

recovered

as and when funds are available in the account.

Recovery of contribution for delayed payments

APY module will raise demand on the due date and continue to raise demand till the amount is recovered from

the subscriber’s

account. The due date for recovery of monthly contribution may be treated as 15th or any day in the calendar

month

for each subscriber. Bank can recover amount any day till the last day of the month. It will imply that

contribution

are recovered as and when funds are available any point during the month. Contribution will be recovered along

with

the overdue interest if applicable. All subscribers under APY remain connected on their mobile so that timely

SMS

alerts can be provided to them at the time of making their subscription, auto-debit of their accounts and the

balance

in their accounts.

Exit and pension payment

Upon completion of 60 years, the subscribers will submit the request to the associated bank for drawing the

guaranteed

minimum monthly pension or higher monthly pension, if investment returns are higher than the guaranteed returns

embedded

in APY. The same amount of monthly pension is payable to spouse (default nominee) upon death of subscriber.

Nominee

will be eligible for return of pension wealth accumulated till age 60 of the subscriber upon death of both the

subscriber

and spouse. Settlement of funds is subject to PFRDA approval.

In case of death of subscriber due to any cause after the age of 60 years, pension would be available to the

spouse

and on the death of both of them (subscriber and spouse), the pension wealth accumulated till age 60 of the

subscriber

would be returned to the nominee. Settlement of funds is subject to PFRDA approval.

Exit before the age of 60 Years: Voluntary exit in APY is permitted. In case a subscriber, who has availed

Government

co-contribution under APY, chooses to voluntarily exit APY at a future date, he shall only be refunded the

contributions

made by him to APY, along with the net actual accrued income earned on his contributions (after deducting the

account

maintenance charges). The Government co-contribution, and the accrued income earned on the Government

co-contribution,

shall not be returned to such subscribers.

Death of subscriber before 60 years:

-

In case of death of the subscriber before 60 years, option will be available to the spouse of the subscriber

to continue

contribution in the APY account of the subscriber, which can be maintained in the spouse’s name, for the

remaining

vesting period, till the original subscriber would have attained the age of 60 years. The spouse of the

subscriber

shall be entitled to receive the same pension amount as the subscriber until death of the spouse.

- Or, the entire accumulated corpus under APY will be returned to the spouse / nominee. Settlement of funds

are is

subject to PFRDA approval.

NOTE: In case of death of the customer, spouse / nominee can download the Account Closure Death form. Fill

in the details, attach proofs as mentioned in the form & post it at Customer Support – Airtel Payments Bank

Ltd.,

Airtel Center Plot No.16 Udyog Vihar Phase IV Gurugram, 122015 – Haryana

Customer Support

Customer can contact the Airtel Payments Bank customer care numbers 1800-23400 for any

queries

related to Atal Pension Yojana.

Additionally, customer can also call at Toll Free Number 1800-110-069 of Atal Pension Yojana (PFRDA) to make

any enquires

or get information at

Click here or download the APY app to view

account details / contributions

paid / transaction statement. Link to download the APY app -

Click here

To register complaint with PFRDA Ombudsman, you may write to:

The Office of Ombudsman

Pension Fund Regulatory and Development Authority

Tower E, 5th Floor, E-500, World Trade Center,

Nauroji Nagar, New Delhi- 110029

Phone No: 011 - 40717900

E-mail Id: ombudsman@pfrda.org.in