| Overview: Saving money requires discipline, smart planning, and the right strategies. This comprehensive guide provides practical money-saving tips, budgeting techniques, and investment methods specifically designed for Indian households. Learn how to create a sustainable money-saving plan that builds long-term wealth without compromising your lifestyle. |

Why Indians Struggle to Save Money Despite Good Intentions

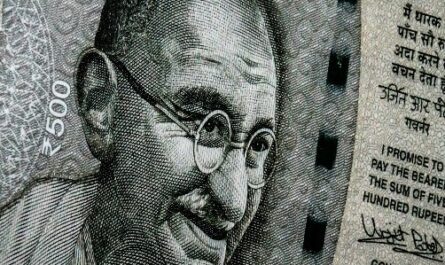

Most urban Indians earn decent salaries but find it challenging to save money consistently. RBI data shows that household savings rates have declined to 19-22% of income in 2024, compared to 25% a decade ago. The culprit? Lifestyle inflation and poor money-saving techniques.

Get high ROI with 8.4% on Fixed Deposits. Invest today

Consider this: spending ₹200 daily on outside food equals ₹73,000 annually. These small leaks drain your finances faster than you realise. The good news is that effective money-saving methods can help you plug these gaps without drastically changing your lifestyle.

Build a Strong Foundation with Emergency Savings

A foundational step toward building long-term financial stability is to start with a straightforward budget framework that helps manage spending and prioritise savings.

Start with the 50-30-20 Rule

The most effective money-saving plan follows a simple formula:

- 50% for needs (rent, groceries, utilities)

- 30% for wants (entertainment, dining out)

- 20% for savings and investments

For high-rent cities like Mumbai or Bangalore, adjust this to 60-20-20. Here’s how it works for someone earning ₹50,000 monthly:

| Category | Amount | Examples |

| Needs (50%) | ₹25,000 | Rent, groceries, utilities, transport |

| Wants (30%) | ₹15,000 | Movies, dining out, shopping |

| Savings (20%) | ₹10,000 | FD, SIP, emergency fund |

Calculate Your Emergency Fund Target

Financial experts recommend saving 6-8 months of essential expenses. For an urban family spending ₹45,000 monthly on core needs, the target emergency corpus is:

Emergency Fund = ₹45,000 × 6 = ₹2.7 lakh

This calculation ensures you can handle job loss, medical emergencies, or unexpected expenses without borrowing at high interest rates.

| Pro Tip: Open an Airtel Finance Fixed Deposit to park your emergency fund. It earns higher interest than savings accounts while maintaining liquidity for genuine emergencies. |

Smart Ways to Save Money Through Automation

To consistently build wealth and achieve financial goals, adopting intentional savings habits is crucial.

Pay Yourself First Strategy

The most successful money-saving techniques involve automation. Set up automatic transfers on salary day to remove the temptation of spending what you planned to save.

Example: Priya, a software engineer earning ₹60,000, automates:

- ₹12,000 to SIP (equity mutual funds)

- ₹6,000 to fixed deposit (emergency fund)

- ₹2,000 to PPF (tax saving)

This systematic approach helps her save ₹20,000 monthly without conscious effort.

The Compound Interest Magic

Understanding compound interest transforms your money-saving methods. Here’s the formula:

A = P(1 + r/n)^(nt)

Where:

- A = Final amount

- P = Principal amount

- r = Annual interest rate

- n = Compounding frequency

- t = Time in years

Calculation Example: ₹1 lakh invested at 8% annual interest compounded quarterly for 5 years:

A = 1,00,000(1 + 0.08/4)^(4×5)

A = 1,00,000(1.02)^20

A = ₹1,48,595

Your money grows by ₹48,595 through compound interest alone.

Practical Money-Saving Ideas for Daily Life

Start building your financial discipline with the 52-Week Savings Challenge, a structured plan designed to gradually boost your savings while keeping you motivated throughout the year.

The 52-Week Savings Challenge

This popular money-saving technique requires discipline but delivers impressive results:

- Week 1: Save ₹50

- Week 2: Save ₹100

- Week 3: Save ₹150

- Continue increasing by ₹50 weekly

By week 52, you’ll save ₹2,600 that week, with total savings of ₹68,900 for the year.

Cut Hidden Expenses

Track every expense for 30 days to identify money drains:

- Subscription audit: Cancel unused OTT, gym, or app subscriptions

- Daily coffee habit: ₹120 daily = ₹3,600 monthly

- Impulse online purchases: Set 24-hour cooling periods

- Unnecessary cab rides: Use public transport twice weekly

| Did You Know? The average urban Indian spends ₹4,500 monthly on subscriptions they rarely use. Cutting just half can boost your money-saving plan by ₹27,000 annually. |

Investment Options to Grow Your Savings

When evaluating options for growing savings, it’s important to understand how fixed deposits compare to mutual funds across key parameters such as risk, returns, flexibility, and tax implications.

Fixed Deposits vs Mutual Funds Comparison

| Investment | Risk Level | Expected Returns | Lock-in Period | Tax Treatment |

| FD | Low | 6-8% | Flexible | Taxable as income |

| Equity MF | Moderate-High | 12-15% (long-term) | None | LTCG: 12.5% above ₹1.25L |

| Debt MF | Low-Moderate | 7-9% | None | LTCG: 20% with indexation |

SIP Calculation Example

Monthly SIP of ₹5,000 at 12% annual returns:

Year 5: ₹4.1 lakh (₹3 lakh invested + ₹1.1 lakh returns)

Year 10: ₹11.6 lakh (₹6 lakh invested + ₹5.6 lakh returns)

Year 15: ₹25 lakh (₹9 lakh invested + ₹16 lakh returns)

The power of compounding becomes evident in longer timeframes.

| Mistake to Avoid: Don’t stop SIPs during market downturns. These periods often provide the best buying opportunities for long-term wealth creation. |

Budgeting and Saving with Technology

Digital tools have revolutionised personal finance, making it easier than ever to save, manage expenses, and optimise financial health through convenient, tech-based solutions.

Digital Tools for Money Management

Modern money-saving methods leverage technology:

- Expense tracking apps: Walnut, Money View, ET Money

- Automated savings: Standing instructions for investments

- Bill reminders: Avoid late payment penalties

- Goal-based saving: Separate funds for different objectives

Advanced Money-Saving Techniques

To optimise your finances and reduce tax liabilities, consider implementing tax-efficient saving strategies that leverage government-backed schemes and smart borrowing options.

Tax-Efficient Saving Strategies

Maximise Section 80C deductions through:

- PPF contributions (₹1.5 lakh limit)

- ELSS mutual funds (tax-saving + growth potential)

- Life insurance premiums

- Tax-saving fixed deposits

Loan Against Assets

Instead of personal loans at 12-18% interest, consider:

- Loan against FD: 1-2% above FD rate

- Gold loans: 12-15% interest with minimal documentation

- Property loans: Lowest rates but longer processing

Save Money and Take Charge of Your Life

Your money-saving journey requires patience, discipline, and the right financial products. Start small, stay consistent, and let compound interest work its magic. Whether building an emergency fund, planning for major purchases, or securing your retirement, effective money-saving methods ensure financial stability and growth.

The key is taking action today. Open a fixed deposit account by Airtel Finance, start your SIP, or begin tracking expenses. Small steps taken consistently lead to significant wealth accumulation over time. Remember, every rupee saved and invested wisely brings you closer to financial independence.

Get high ROI with 8.4% on Fixed Deposits. Invest today

FAQs

1. What is the best way to save money if I earn less than ₹30,000 monthly?

Start with a small fixed amount like ₹1,500 monthly in a recurring deposit. Use budgeting methods to track expenses and cut unnecessary spending gradually.

2. How much should I save from my salary for emergencies?

Aim to save money equal to 6-8 months of essential expenses. Start with 10% of salary and gradually increase using systematic money-saving techniques.

3. Can I break my fixed deposit in case of emergency?

Yes, most FDs allow premature withdrawal with penalty charges. Check specific terms when opening your account to understand the implications on returns.

4. Which is better for saving money: FD or mutual funds?

FDs suit conservative savers seeking guaranteed returns. Mutual funds offer higher potential returns but carry market risks. Diversify based on goals and risk tolerance.

5. How do I automate my monthly savings effectively?

Set up standing instructions on salary day to transfer fixed amounts to different savings instruments. This money-saving plan removes emotional decision-making from the process.