| Overview: Building a secure financial future requires practical planning, disciplined saving, and smart credit usage. This blog outlines essential financial stability tips, covering saving strategies, responsible borrowing, and effective tools to manage personal finances. Learn how to stay financially resilient through informed choices and structured approaches tailored for every income level. |

Strengthen Your Finances, One Step at a Time

India’s growing middle class is increasingly prioritising financial preparedness. As per RBI data, household financial savings has dipped substantially, revealing an urgent need for conscious financial planning. Rising expenses and unplanned credit use often strain monthly budgets.

Achieving a secure financial future is not a one-time goal but an ongoing journey of discipline, awareness, and smart resource use. With the right support and practical tools like personalised loan plans and saving options, individuals can build resilience and stay prepared for unforeseen challenges.

Foundations of a Secure Financial Future

A secure financial future is not about wealth alone, but the ability to meet life’s needs without stress. This includes having adequate savings, manageable debt, and access to flexible credit when necessary.

Key Elements to Focus On:

- Budgeting: Know where every rupee goes.

- Emergency Fund: Build a fund covering at least 6 months of expenses.

- Debt Management: Avoid high-interest debt; prioritise timely repayments.

- Goal-Oriented Savings: Short- and long-term goals like home purchase, education, retirement.

How Airtel Finance Supports This

Through solutions like Airtel Flexi Credit, users can choose loan amounts, EMIs, and tenure as per need—ideal for managing personal finances during emergencies or planned expenses.

Quick Look: Airtel Finance Personal Loan Offerings

| Feature | Description |

| Loan Amount | Up to ₹9 lakhs |

| Application Process | 100% Digital, Paperless |

| Tenure | Flexible—as per borrower’s choice |

| EMI and Repayment | Customisable |

| Speed | Instant Approval |

| What You Must Know: A flexible loan is better than fixed high-interest credit cards during emergencies. |

Diversify Financial Tools

Diversification builds stability. Combine savings with credit flexibility.

- Fixed Deposits With High ROI: Airtel Finance FDs are RBI-approved.

- Airtel EMI Card: Buy over 1 million+ items across 4000+ cities.

- Airtel Axis Bank Credit Card: Save up to ₹18,000 per year with cashback & benefits.

You can explore Airtel Flexi Credit for quick financial support today

Financial Stability Tips

This section provides hands-on, realistic financial stability tips that fit into Indian lifestyles and earning patterns.

Smart Spending Habits

Being financially stable doesn’t mean no spending—it means spending smart.

- Track expenses using mobile apps.

- Limit monthly UPI/subscription spending.

- Avoid impulsive online shopping.

Save Before You Spend

Set up automatic monthly transfers to a savings or fixed deposit account. Airtel Finance Fixed Deposits offer digital account opening and higher returns, ideal for mid- to long-term savings.

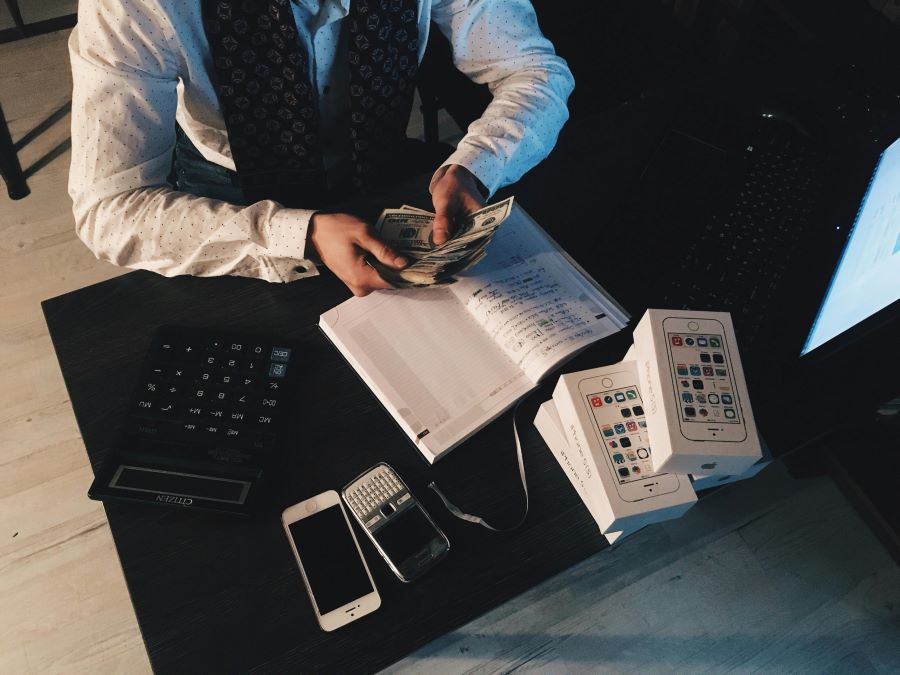

Leverage Credit—Don’t Let It Control You

Well-managed credit can strengthen your finances. Mismanaged debt can destroy it.

- Use EMI cards to spread out big purchases

- Opt for personal loans with transparent terms

- Pay credit card dues in full—avoid minimum payments

- Consider debt refinancing for better rates and repayment flexibility

| Mistake to Avoid: Never treat credit as income—it’s a liability. |

Build a Personal Finance Calendar

Track the following on a yearly calendar:

- Insurance renewals

- FD maturity dates

- EMI due dates

- Loan closures

- Investment reviews

Check Your Credit Score Regularly

Airtel Finance offers a free credit score checker. A higher score helps you access personal loans and cards easily. Also, monitor the CIBIL report DPD to avoid negative score impacts.

Long-Term financial stability tips

- Begin SIPs in mutual funds once you’ve built your emergency fund

- Reinvest FD maturity returns smartly

- Limit lifestyle inflation (rising expenses with rising income)

- Create a secondary income source if possible

Basic Vs Advanced Financial Stability Approaches

Progressing from basic to advanced financial habits can significantly enhance your ability to manage money and secure your financial future.

| Category | Basic Action | Advanced Action |

| Emergency Fund | ₹50,000 in savings | 6–9 months of expenses in liquid fund |

| Credit Management | No missed EMIs | Debt-to-income ratio below 30% |

| Savings | Single FD | FDs + Mutual Funds + PPF |

| Budgeting | Monthly tracking via notebook | Budgeting apps + spending limit alerts |

| Important to Know: Lifestyle creep is real—control it early for better savings. |

Managing Personal Finances for the Long Run

Long-term financial health is built through consistent habits, informed choices, and smart planning across all life stages.

Prioritise Financial Literacy

Indians are highly tech-savvy but often lack financial know-how. Understanding interest rates, credit behaviour, and inflation is crucial.

- Read basic finance blogs

- Subscribe to finance YouTube channels

- Understand financial products before investing, including compound interest

Plan for Life Events

Different stages need different strategies.

| Life Stage | Common Needs | Planning Tool |

| Early Career | Rent, EMIs, emergency fund | Personal loan, credit card |

| Mid-Career | Child education, home loan | Fixed deposit, mutual funds |

| Retirement | Passive income | PPF, FDs, low-risk SIPs |

| Fact to Know: A 1% extra ROI on FDs can yield thousands more annually. |

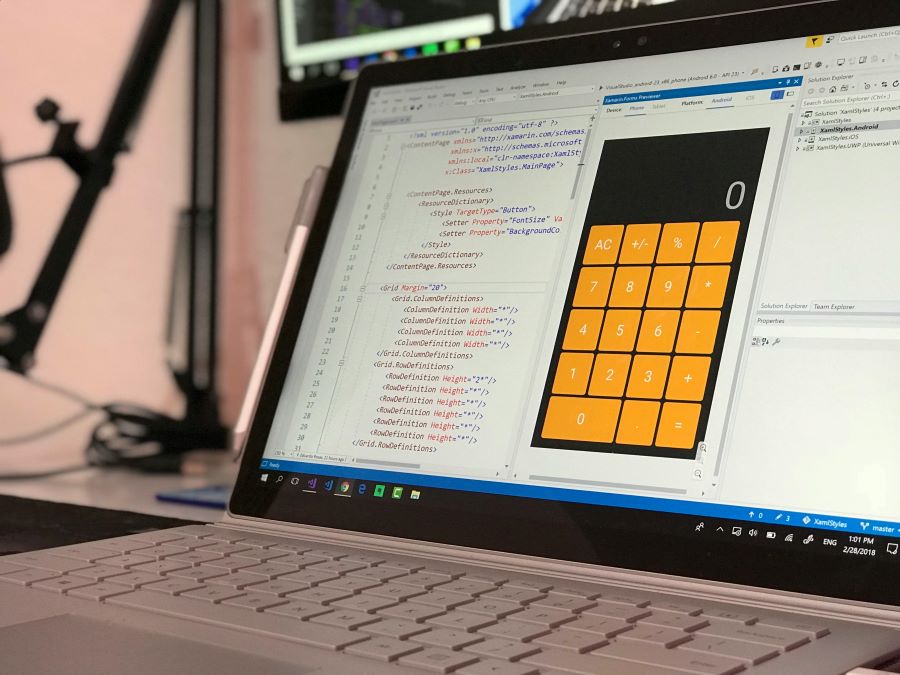

Combine Tech with Discipline

Fintech solutions like Airtel Finance make managing personal finances simpler:

- 100% digital processing

- Safe platforms

- Personalised offers

- Instant approvals

Stay disciplined in usage even with smart tools. Also, be mindful of contingent liabilities that may affect your financial future.

Comparison: Airtel Finance vs Traditional Banks

Choosing the right financial partner can greatly impact how effectively you manage personal loans and savings.

| Feature | Airtel Finance | Traditional Banks |

| Application Process | Online, 100% digital | Often requires paperwork |

| Custom Loan Options | Highly flexible | Standardised |

| Approval Speed | Instant or within minutes | May take several days |

| Credit Score Support | Inbuilt credit score checker | Third-party check often needed |

| EMI Card for Purchases | Yes, 1M+ products | Not widely available |

Final Thoughts on Securing Your Financial Future

True financial stability isn’t achieved overnight—it’s the result of conscious planning, disciplined habits, and access to reliable financial tools. Whether it’s handling emergencies or preparing for major life goals, choosing the right support makes all the difference.

Airtel Finance offers digital, flexible, and secure financial solutions tailored to modern needs, helping individuals manage money on their own terms. With options like Flexi Credit and high-return FDs, you can move forward with confidence and control. Take control with Airtel Finance’s smart financial tools today.

FAQs

- How can I start building a secure financial future?

Begin by budgeting monthly expenses, saving consistently, creating an emergency fund, and using flexible credit products like personal loans when necessary. - What are some practical financial stability tips for beginners?

Track spending, save first, limit debt, build a credit score, and explore low-risk investment options for consistent financial growth. - How can I use credit wisely without falling into debt?

Use EMI options, repay loans on time, track dues, and avoid unnecessary credit. Airtel Flexi Credit offers controlled, flexible borrowing solutions.

- Why is managing personal finances important in today’s economy?

Managing finances helps avoid debt traps, ensures preparedness for emergencies, and supports achieving long-term goals like education, homeownership, or retirement. - Is an emergency fund really necessary for financial stability?

Yes, it protects against job loss, medical emergencies, or urgent expenses, preventing reliance on high-interest credit during critical times.