| Overview: Choosing between instant loans and traditional bank loans depends on your financial urgency, documentation readiness, and comfort with digital processes. While traditional loans offer structure and low interest, instant loans provide speed and flexibility. Understanding their benefits and limitations helps in making a practical borrowing decision suitable for your financial needs. |

Is Speed the Future of Lending? A Look at India’s Borrowing Trends

India has witnessed a 48% surge in digital lending in the past two years, with platforms offering instant loans online becoming increasingly popular among younger demographics. According to the Reserve Bank of India, personal loans contributed to over ₹40 lakh crore of outstanding retail credit in 2023.

While banks still dominate, fintech-driven platforms now cater to over 30% of new borrowers, highlighting a clear shift towards quick personal loans and quick loan approval methods.

Introduction to Loan Options in India

Borrowing money is a common need, whether it’s for education, travel, emergencies, or major purchases. Indian borrowers today face a vital choice: go with modern instant loans online or apply for conventional traditional loans through banks. Each has its strengths, depending on your financial behaviour, credit score, urgency, and repayment ability.

With digital platforms like Airtel Finance offering personalised loan solutions, it’s crucial to evaluate both types of loans across various parameters such as approval speed, documentation, cost, flexibility, and eligibility.

Understanding Instant Loans

Instant loans online are digital, short-to-medium term personal loans approved within minutes. These loans are typically offered by fintech platforms, NBFCs, or digital partners of traditional banks.

Key Features of Instant Loans:

- 100% online application and approval

- Minimal documentation required

- Approval within minutes to hours

- Personalised loan amounts and tenure

- Flexible repayment options

- Ideal for emergency or immediate funding needs

Most quick personal loans are processed via mobile apps or websites, making them easily accessible even in semi-urban and rural areas.

Common Use Cases for Instant Loans

- Medical emergencies

- Travel or wedding expenses

- Home repairs or electronics purchase

- Short-term cash flow shortages

Apply with Airtel Finance for instant loan approval today!

Understanding Traditional Bank Loans

Traditional loans are offered by established banks and require a detailed process involving physical documentation, creditworthiness assessment, and in-person visits. While time-consuming, they’re considered stable and reliable.

Features of Traditional Bank Loans:

- Longer approval and disbursal time (3–10 days)

- In-depth credit checks and documentation

- Lower interest rates (depending on credit score)

- Larger loan amounts available

- Rigid structures on tenure and EMI

Traditional loans are best suited for long-term, higher-value financing needs such as home renovation, vehicle purchase, or business expansion. In some cases, borrowers may benefit from government-backed loan subsidies for specific purposes.

Comparison Table: Instant Loans vs Traditional Loans

| Feature | Instant Loans Online | Traditional Loans |

| Approval Speed | Within minutes to a few hours | 3 to 10 working days |

| Application Method | Entirely digital | Mostly physical, some online |

| Documentation | Minimal | Extensive (KYC, income proof) |

| Loan Amount | Usually ₹10,000 to ₹5 lakhs | ₹50,000 to ₹50 lakhs or more |

| Interest Rates | Slightly higher (due to risk) | Lower (secured loans) |

| Flexibility | High (loan amount and tenure) | Moderate |

| Ideal For | Emergencies, quick cash | Long-term investments |

| Accessibility | Pan-India via apps | Branch-based, slower outreach |

Eligibility & Approval Process: A Closer Look

Instant Loans

- Fast quick loan approval through algorithms and alternative data

- Credit score important but not always mandatory

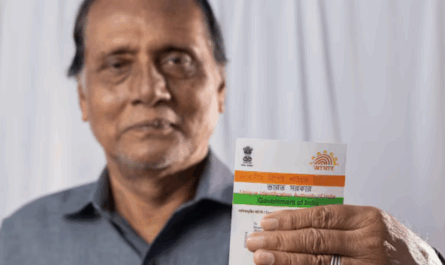

- E-KYC using Aadhaar and mobile OTP

- Source: Digital footprints (like UPI spends, salary account activity)

Low CIBIL score may not always stop you from getting an instant loan if other criteria are favourable.

Traditional Loans

- In-depth financial and employment verification

- Requires CIBIL score above 700

- Multiple documents and guarantor may be needed

- Physical verification in some cases

| What You Must Know: Instant loans are unsecured – defaulting may impact credit health significantly more than secured traditional loans. |

Documentation Requirements

| Document Type | Instant Loans Online | Traditional Loans |

| ID Proof | PAN, Aadhaar | PAN, Aadhaar |

| Address Proof | Self-declared in many | Utility bill, Aadhaar |

| Income Proof | Optional in many apps | Salary slips, bank statement |

| Bank Statement | Few months | Mandatory 6-months record |

| Employment Proof | Sometimes waived | Mandatory |

| Mistakes to Avoid: Borrowing without checking repayment capacity can lead to EMI defaults and CIBIL damage. |

Repayment and Tenure

| Feature | Instant Loans | Traditional Loans |

| Tenure Options | 3 to 24 months | 6 to 84 months |

| EMI Customisation | High (especially in Flexi) | Limited |

| Prepayment Charges | Often zero or minimal | Varies across banks |

| Loan Top-up Facility | Available in select apps | Needs re-application |

Platforms like Airtel Finance offer pre-approved top-up options and reminders for EMI tracking via the app interface. Learn more about personal loan EMI calculations before borrowing.

| Important to Know: Missing just one EMI on an instant loan may drop your credit score by up to 50 points. |

Loan Accessibility: Urban Vs Rural

One of the strong points of instant loans online is digital inclusivity. Thanks to Aadhaar-linked eKYC and UPI integration, many borrowers in Tier 2 and Tier 3 cities can now access quick loan approval without ever stepping into a bank. For those with limited documentation, exploring no credit check loans can be especially beneficial in rural and underserved areas.

Meanwhile, traditional loans still require bank branches or representatives for final approval stages, limiting their penetration in remote areas.

Best Use Scenarios

| Scenario | Recommended Loan Type |

| Medical emergency | Instant loan |

| Buying a car | Traditional bank loan |

| Wedding costs | Instant or Traditional (based on amount) |

| Home renovation | Traditional loan |

| Gadget/electronics purchase | Instant loan via EMI card |

| Education | Traditional loan with subsidy |

When dealing with emergency expenses, explore cover emergency expenses tips to avoid high-interest traps.

Making the Right Loan Choice

When deciding between instant loans online and traditional loans, assess your urgency, repayment ability, and documentation readiness. Instant loans provide unmatched speed and ease, ideal for short-term or emergency needs. Traditional loans, though slower, offer structured terms for long-term financial planning.

For today’s fast-paced world, Airtel Finance stands out with its 100% digital loan process, quick approvals, and personalised credit options. Whether you’re tackling a financial crunch or planning a large purchase, Airtel Finance offers flexibility, trust, and convenience—right from your phone. Check your eligibility on Airtel Finance and apply instantly!

FAQs

1. What is the main difference between instant loans and traditional bank loans?

Instant loans offer fast, online approval with minimal paperwork, while traditional loans require extensive documentation and take longer for processing and disbursal.

2. Are instant loans safe to use in India?

Yes, when taken from trusted platforms like Airtel Finance that follow RBI regulations and use secure digital processes for KYC and disbursal.

3. Can I get instant loans without a strong credit score?

Yes, some platforms assess alternative data, but having a good credit score increases approval chances and helps secure better loan terms.

4. Which loan type is better for emergency expenses?

Instant loans are ideal for emergencies due to their quick approval, minimal documentation, and digital process—making funds accessible within minutes.

5. Do traditional bank loans have lower interest rates than instant loans?

Generally, yes. Traditional loans often offer lower interest rates due to longer tenure and secured lending, unlike instant loans, which are unsecured and faster.