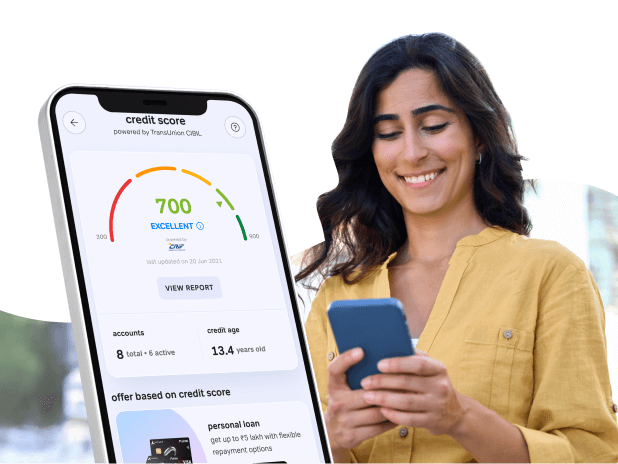

Start Your Credit Journey

Get your free credit score in just 2 minutes. No impact on your credit, completely secure, and instant results.

Airtel Finance trusted by 10 Lakh+ Users

Whether you’re looking to improve your score or already have a great one, this page is designed to help you take the next best step. Backed by insights from top credit bureaus, our expert tips are free, easy to follow, and tailored to where you stand today.

✅ Tips personalized to your credit score

✅ Trusted strategies to improve or optimize your score

✅ 100% digital, educational, and free

Select your main concerns and discover the best ways to overcome them.

Understand what affects your credit score and how it's calculated. Perfect for beginners.

Learn MoreLearn what affects your credit score and how to improve it step-by-step.

Learn MoreDiscover the key factors banks and lenders examine in your credit report before approving your loan.

Learn MoreLearn how credit scores and CIBIL scores differ and why both matter for your financial journey.

Learn MoreStep-by-step guide for people with no credit history to build a strong credit profile.

Learn MorePro tips for optimizing your credit profile and maximizing your financial opportunities.

Learn MoreA score in this range means you’re building credit — but you might be held back by a few common issues. Here’s how to improve your creditworthiness and move into the top tier.

Are you tired of being denied loans or offered high interest rates due to a low credit score? If your CIBIL score is around 500,

Read More

Your credit score is one of the most important numbers in your financial life. It can determine your ability to get loans,

Read More

Your CRIF Credit score is one of the most important indicators of your financial health. Lenders rely on this 3-digit number, ranging

Read More

In the past couple of years, the Indian financial industry has undergone a massive change and has made obtaining credit easier

Read More

Paying off debt is a significant milestone in your financial journey. It not only frees up your cash flow but also has the potential

Read More

One of the most important aspects of maintaining a good credit score is keeping a regular check. Yes, you heard that right! You need

Read More

Navigating the world of loans can be challenging, especially when financial troubles arise. One option to consider during

Read More

Credit cards have gained popularity in the last few years and nowadays, almost every other individual owns at least one credit

Read MoreA high credit score opens doors to premium offers, lower interest rates, and higher approval chances. Here's how to stay ahead while maximizing the benefits.

Achieving an 800 credit score might seem like a daunting task, but it’s entirely possible with the right steps and dedication.

Read More

Your credit score is more than just a number lenders use to assess your loan eligibility. Increasingly, employers are also using credit reports

Read More

Your credit score is a vital component of your financial health, determining your ability to access loans and credit. In India,

Read More

Applying for a new credit card can be an exciting way to take advantage of rewards, build your credit, or manage

Read More

Do you have an unused credit card lying in your wallet? You’re not alone. Many people hold on to credit cards they no longer use, either because

Read More

Marriage is a beautiful partnership, but it also means sharing financial responsibilities. One common concern among married

Read More