One of India’s leading private bank partners with Airtel IQ Spam Protection to safeguard its customers from fraud

-

March 15, 2024

-

4 min read

With an increase in the scale of digital communication, the quantum of messages being sent daily is also on the rise. With that, the menace of spam messaging and phishing via SMS has become one of the most common malpractices today. 60% of Indian citizens receive minimum 3 SPAM messages every week, leading to increasing worries for this leading bank. They were receiving multiple customer complaints, thus losing the brand trust. Within a month of deploying Airtel IQ SpamShield, the bank noticed a 98% reduction in spam messages, 2Mn+ spam messages/day going down to almost zero, 8K+ imposter headers blocked and 160K+ potentially fraud content templates blocked!

The Challenge

Loss of customer trust & increased grievances for the bank

Many customers of this bank were tricked by phishing scams because they couldn’t tell the difference between messages from the bank and fake ones. The spam messages looked very similar to real bank messages, but they came from fake phone numbers and contained links that stole money from users’ accounts. The messages made it seem urgent, like users would miss out on great deals if they didn’t act quickly. Unfortunately, many users fell for it without realizing it was a scam. This caused a lot of problems for the bank because they had to deal with many customers asking for their money back after being scammed. It also made the customers frustrated and worried about the security of their accounts, and resulted in the bank losing customer credibility.

The Solution

Detect spam at source and prevent it from ground zero

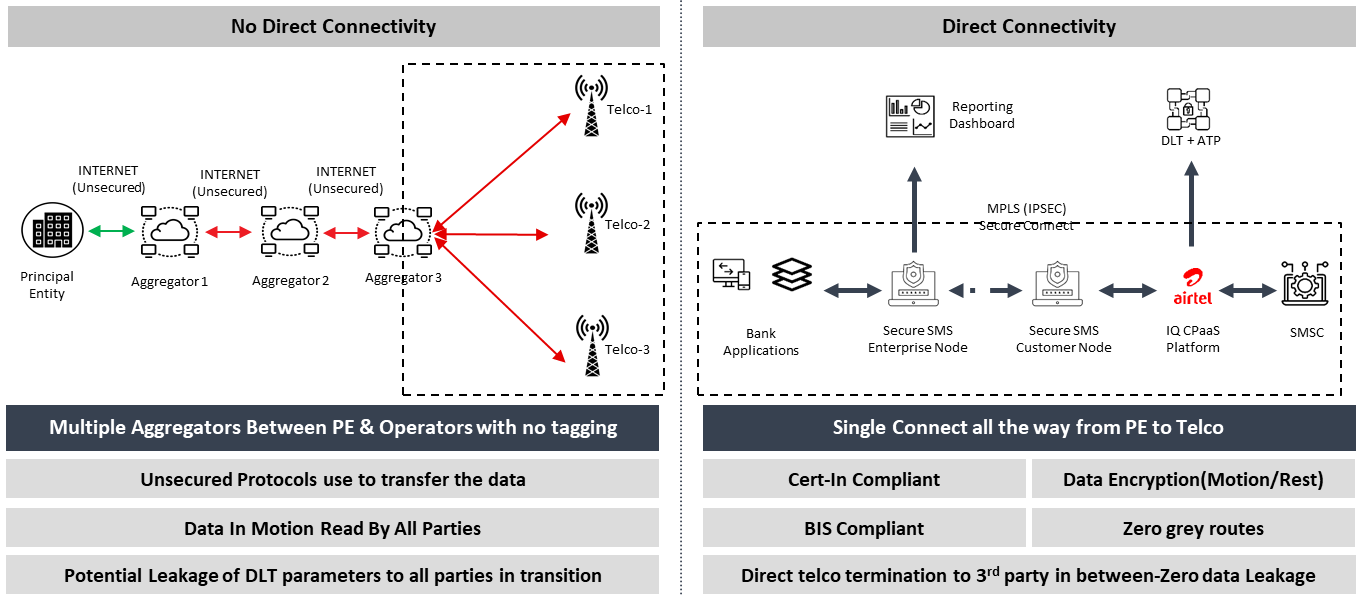

Airtel introduced Airtel IQ Spam Shield, an AI/ML based solution aimed at tackling the rising spam issues. SpamShield operates and focuses on three key aspects: Detection, Prevention and Suspension. Using advanced algorithms, AI/ML + Social Graph based fingerprinting to differentiate an actual enterprise sender from spam. Every enterprise has a set of whitelisted sender ids that they use for different types of communication. When a message from an unspecified sender id or fake sender id passes through the secure nodes of both the client and Airtel, it is mapped against the listed ids and the discrepancies found are sent as alert reports to the client. For Application-to-Person (A2P) communications, the platform ensures thorough fraud checks for messages sent through its systems. The checks include but are not limited to unfamiliar CTAs, request for personal data and dubious sender ids. The system then suspends those sender IDs, message content templates, and suspicious numbers or domains used in fraudulent messages. This ensures the messages that are in the pipeline are blocked and the fake ids and templates cannot be used again. It prevents data leakage by establishing a direct connectivity using a secure MPLS connection between enterprise and telco to prevent any unscrupulous tampering of reports.

As an added service, Airtel ensures the templates are whitelisted, the sender ids are DLT approved and the messages are sent directly to the end customer via the client’s unique secure node only. If any fraudulent messages are found, alerts, fraud inciting materials (Fraudulent number, CTA) shared with enterprise, government and other TSPs. This ensures suspension of the Sim boxes, sender IDs, content templates and numbers/domains used inside smishing messages, thereby safeguarding the bank’s customers from potential frauds.

The Impact

Reduced spam messages, blocked fraudulent headers, potential fraud templates blocked.

After implementing new measures, the bank quickly saw a big drop in fake messages within just two weeks. By consistently blocking these messages, the bank is making sure its communication channels stay safe and trustworthy for its users. The bank noticed a 98% decrease in spam messages, going from over 2 million spam messages a day to almost none at all. They’ve also managed to block more than 8,000 suspicious SMS headers and prevented over 160,000 potential frauds by blocking harmful content and templates. Even at 1% conversion, there would have been 20,000 consumers being scammed everyday, if not for Airtel IQ SpamShield.

By implementing these robust measures, the bank successfully protected its users from a significant amount of spam and potential fraud. This highlights the importance of proactive security solutions in safeguarding communication channels and maintaining user trust.

Share

Share