| Overview: With the rise of digital lending, countless loan apps have emerged, some legitimate and others fraudulent. Before downloading any loan app, it’s vital to confirm its authenticity to avoid data theft, hidden charges, and scams. Verifying a loan app ensures your safety, financial credibility, and peace of mind. |

Think Before You Tap: Ensuring Your Loan App Is Legit

The convenience of digital lending has made borrowing faster than ever. Yet behind many glossy app icons hide unverified lenders waiting to misuse personal data or impose unfair terms. Before trusting any loan app, it’s essential to take a few smart steps to confirm its legitimacy. By taking a moment to verify loan app authenticity, you protect your finances, privacy, and credit reputation.

From checking registration details to reading genuine user reviews, a little awareness goes a long way in ensuring your borrowing journey remains safe and stress-free.

Steps to Verify a Loan App Before Downloading

Before downloading any loan app, it’s crucial to follow these essential checks to ensure you’re dealing with a legitimate, secure, and RBI-compliant lender.

1. Check RBI or NBFC Registration

Always confirm whether the loan app is backed by an RBI-registered Non-Banking Financial Company (NBFC) or a regulated financial institution. You can cross-check this on the official RBI website.

- RBI registration number should match the lender’s name on the app.

- Apps without clear NBFC partnership are potential red flags.

| Important to Know: Unregistered apps cannot legally disburse or recover loans under Indian financial law. Also, be cautious of loan sharks who operate outside RBI regulations. |

2. Verify the Developer and Publisher Details

Go to the app store and check who published the app.

- Ensure the developer’s email and company address are legitimate.

- Avoid apps with vague details or unrelated company names.

- Look for verified badges or recognition from official financial bodies.

3. Examine App Permissions and Privacy Policy

A genuine loan app only requests permissions necessary for identity verification and processing.

| Check | Legitimate Apps | Suspicious Apps |

| Permissions | Access to PAN, Aadhaar, contacts (if justified) | Access to photos, audio, or messages |

| Privacy Policy | Clear, available on official website | Hidden or missing |

| Data Use | Transparent about storage and purpose | No disclosure |

Always verify loan app permissions before agreeing to terms. Before sharing sensitive details, learn about KYC requirements and how they protect you.

4. Analyse Website Authenticity

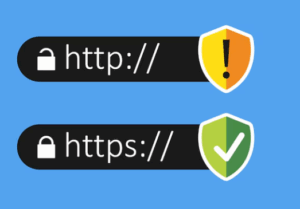

Legitimate lenders maintain active, SSL-secured websites with contact details and support options.

- Check if the domain starts with “https://”.

- Review user feedback on trusted financial forums.

- Ensure customer support exists beyond social media.

| Facts to Know: Most fake apps use cloned websites. Always type the official lender URL manually instead of clicking ad links. |

5. Read Customer Reviews and News Mentions

Reputed loan providers often feature in credible financial publications or review portals.

- Search the app name on Google News to confirm credibility.

- Read 3-star reviews for genuine pros and cons.

- Avoid apps recently uploaded with very few downloads.

If you have ever faced a loan rejection, ensure it wasn’t due to interacting with unverified lenders.

6. Choose Trusted Platforms

Apps from banks or telecom-linked financial services are safer due to stricter compliance.

For example, Airtel Finance Personal Loan offers loans up to ₹9 lakhs through a 100% digital process, backed by RBI-registered partners. Borrowers can easily check eligibility and documents via the Airtel Thanks app.

7. Verify Loan App Using Government Sources

To verify loan app authenticity:

- Visit the Ministry of Finance or RBI public notices section.

- Report suspicious apps on the National Cyber Crime Portal (gov.in).

- Avoid apps circulating through WhatsApp or random social media ads.

Final Word: Choose Security Before Speed

Digital loans can be convenient, but caution is key. Always verify loan app authenticity through RBI records, app permissions, and privacy checks. Genuine lenders will never pressure you into instant approvals or access to personal media.

Opting for recognised platforms like Airtel Finance Personal Loan ensures security, transparency, and flexibility, offering instant disbursals and low processing fees. With Airtel’s trusted network and RBI-compliant lending partners, you can borrow confidently and safely.

Frequently Asked Questions

Q1. How can I verify a loan app before downloading it?

Check RBI registration, read reviews, and confirm the developer’s legitimacy before granting any app access or permissions.

Q2. Why is it important to verify loan app authenticity?

It prevents data theft, hidden charges, and fraud, ensuring your personal and financial information stays fully protected and secure.

Q3. What red flags indicate a fake loan app?

Unclear contact details, excessive permissions, poor reviews, and absence of RBI-registered partners often signal potential fraud.

Q4. Can fake loan apps misuse my personal data?

Yes, fraudulent apps can access your contacts, photos, and identity documents to harass or exploit you financially.

Q5. Where can I report a suspicious loan app in India?

Report to the National Cyber Crime Portal or RBI’s official grievance channels for investigation and quick preventive action.