| Overview: Discover how minor PAN card errors can derail your loan application and learn the complete online correction process. Get step-by-step guidance on using the PAN card rectification form, required documents, and timeline to ensure smooth loan approvals without unnecessary delays. |

Why PAN Errors Block Your Financial Goals

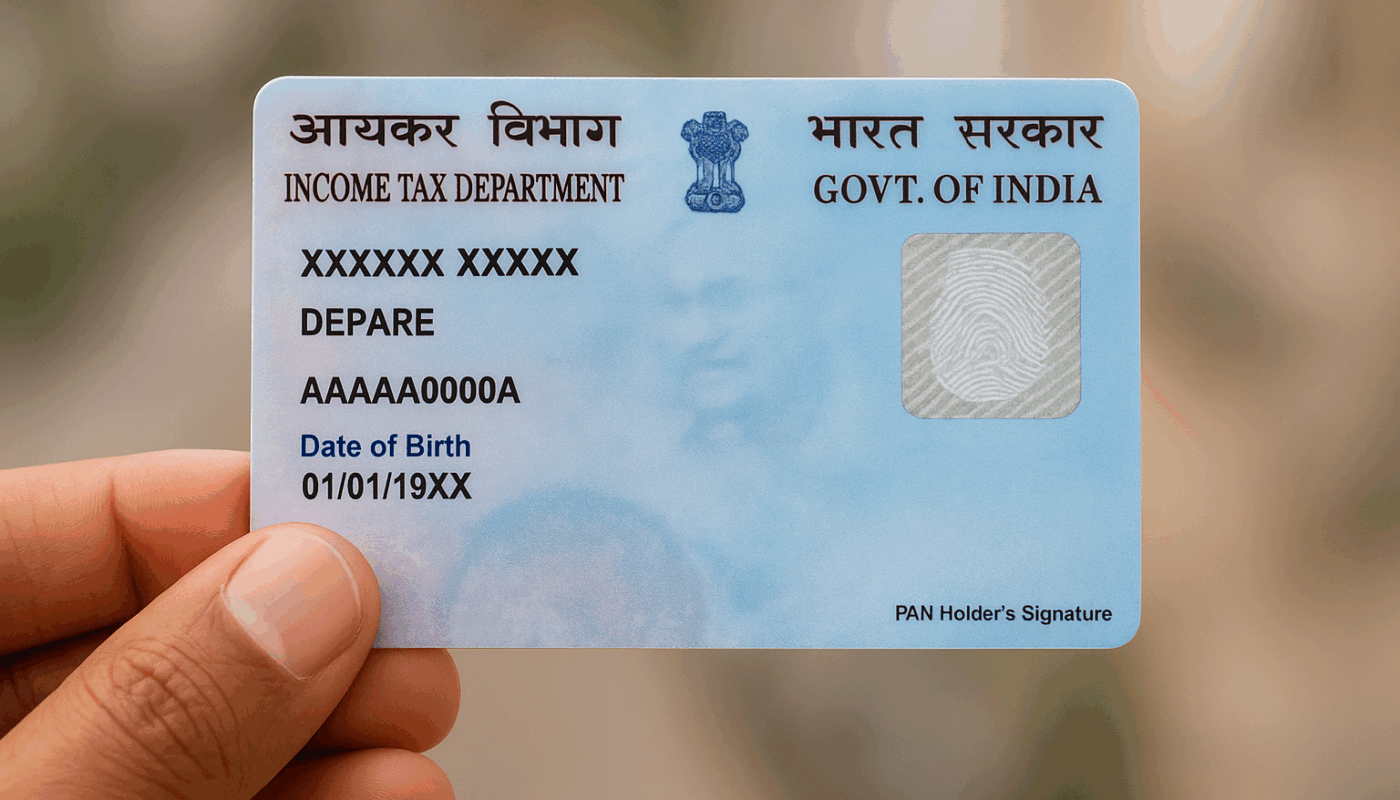

Over 55% of personal loan applications in India are rejected due to incorrect KYC details, including PAN errors. A misspelt name or wrong date of birth on your PAN card might seem trivial, but these small mistakes can completely halt your loan approval process. With digital lending growing rapidly, lenders now rely heavily on automated systems that flag any mismatch between your PAN details and other documents. Understanding how to rectify these errors through the PAN card rectification form can save you weeks of delay and potential rejection.

How Small PAN Mistakes Create Big Problems

Small errors in your PAN card can lead to significant delays.

Identity Verification Failures

Lenders use your PAN card as the primary identity document for loan processing. When your PAN shows “Rahul Kumar” but your salary certificate shows “Rahul Kumaar”, the system automatically flags this as a mismatch. Digital-first lenders like Airtel Finance require accurate PAN details for instant personal loan approvals, making even minor spelling errors a roadblock.

Credit Score Access Issues

Your credit score is linked to your PAN number. If your PAN contains errors, credit bureaus may not provide accurate scores to lenders. Nearly 30% of Indian adults have reported PAN errors discovered during financial applications.

Common PAN Errors That Delay Loans

- Name spelling mistakes: Extra letters, missing middle names, or incorrect spellings

- Wrong date of birth: Mismatched with Aadhaar or other documents

- Outdated address: Old residential details that don’t match the current proof

- Father’s name errors: Spelling mistakes or format differences

| Did you know? Digital-first financial services have experienced rapid growth, with over 60% of urban Indians preferring to complete online PAN corrections and loan applications. |

Step-by-Step PAN Card Rectification Process

Here’s how to rectify your PAN card:

Online Correction via Official Portals

The PAN card rectification form is available through the NSDL and UTIITSL websites. Here’s the complete process:

- Visit the official portal: Go to tinpan.nsdl.com or utiitsl.com

- Select correction type: Choose “Changes or Correction in PAN Data”

- Fill the rectification form: Enter correct details and specify errors to be fixed

- Upload documents: Submit proof for each correction (identity, address, DOB proof)

- Pay fees: ₹110 for online applications, ₹135 for physical submissions

- Track status: Use the acknowledgement number to monitor progress

Required Documents for PAN Correction

- Identity proof: Aadhaar card, voter ID, or passport

- Address proof: Utility bills, bank statements, or rental agreement

- Date of birth proof: Birth certificate, school certificate, or Aadhaar

- Existing PAN card: Copy of the current PAN with errors

- Supporting documents: Marriage certificate for name changes, etc.

Processing Timeline

The online PAN correction typically takes 7–15 working days. During this period, avoid applying for loans, as mismatched details will likely result in rejections.

In a Nutshell

Modern loan applications are increasingly automated, making accurate documentation crucial for quick approvals. By ensuring your PAN card is error-free, you can secure a personal loan without the frustration of rejections or delays. The small effort of using the PAN card rectification form today can save significant time when you need financial assistance urgently. Visit the Airtel Thanks app to check eligibility.

FAQs

1. What happens if I apply for a loan with wrong PAN details?

Your application will likely be rejected or delayed, as lenders cannot verify your identity and credit history with mismatched information.

2. Can I use the PAN card rectification form for address changes?

Yes, the online rectification form allows you to update your address, name, date of birth, and father’s name details.

3. How long should I wait after PAN correction before applying for loans?

Wait at least 15–20 days after receiving your corrected PAN to ensure all databases are updated with new information.

4. Is the PAN card rectification form available in regional languages?

Currently, the official forms are primarily available in English and Hindi through NSDL and UTIITSL portals.

5. What if my loan gets rejected due to PAN errors?

You can reapply after correcting your PAN details, but some lenders may require a waiting period of 30–90 days.