| Overview: A promissory note is a legal document outlining repayment terms between a borrower and lender. In India, it ensures clarity, prevents disputes, and provides enforceability when drafted correctly, making it essential for secure personal, business, and financial loan transactions. |

Promissory Note Format in India—Essential Details You Should Know

A promissory note is a vital financial instrument recognised under the Negotiable Instruments Act, 1881. It is a written promise from one party to pay a certain sum of money to another, either on demand or at a future date. In India, it is widely used in personal lending, business transactions, and even in personal loan agreements with financial institutions.

Correctly drafting this document is crucial because any error in terms, signatures, or amounts can render it invalid in a legal setting.

Understanding the Promissory Note in India

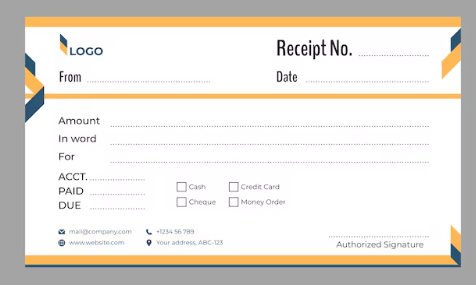

A promissory note in India generally contains:

- Date and place of issue

- Name of the lender and borrower

- Loan amount in words and numbers

- Interest rate (if applicable)

- Repayment terms—instalments or lump sum

- Maturity date (if fixed)

- Signatures of the borrower (and witnesses if needed)

The Promissory Note Format India PDFs can be downloaded from various legal portals, but they must comply with the format recognised by Indian law.

Key Legal Requirements

To make a promissory note enforceable in India, certain legal conditions must be strictly followed.

| Requirement | Description |

| Stamp Duty | Must be paid according to the Indian Stamp Act and state-specific rates |

| Language | Can be in English or any Indian language understood by both parties |

| Signatures | Borrower’s signature is mandatory; witness signatures recommended |

| Amount Specification | Amount in words and figures to avoid disputes |

When is a Promissory Note Used?

Promissory notes are common in:

- Personal lending between individuals

- Business credit transactions

- Loan disbursement records for NBFCs and banks

- Settlement of debts without collateral

For personal loans, especially those offered by modern fintech services, digital promissory notes are becoming common.

Digital Promissory Notes and Personal Loans

In the digital age, lenders often rely on instant cash loans with 100% online processes for amounts up to ₹9 lakh. While physical promissory notes are still valid, many lenders include digital loan agreements that serve a similar purpose, incorporating legal clauses to ensure enforceability.

Comparison: Physical vs Digital Promissory Notes in India

| Feature | Physical Promissory Note | Digital Loan Agreement |

| Execution | Handwritten or printed, signed in person | E-signed via Aadhaar OTP or digital signature |

| Storage | Physical storage required | Cloud or secure digital servers |

| Stamp Duty | Physical stamp paper or adhesive stamps | e-Stamping |

| Speed | Slower due to manual handling | Instant via digital platforms |

| Mistakes to Avoid: Leaving out the repayment date when the agreement is not “on demand” can weaken enforceability. |

Drafting a Promissory Note in India

To create a legally sound promissory note:

- Use the correct format – The Promissory Note Format India PDF should be aligned with RBI and legal standards.

- Mention all parties clearly – Full names, addresses, and identification details.

- Define repayment terms – Lump sum or instalments, interest rates, and due dates.

- State consideration – The purpose for which the money is lent, if relevant.

- Affix proper stamp duty – As per state laws.

Role of Promissory Notes in Airtel Finance Loans

While Airtel Finance operates digitally, the essence of a promissory note exists in its loan agreements through clear repayment commitments, loan amount details, and interest specifications. Borrowers benefit from:

- Instant disbursal within 24 hours

- Flexible EMI and tenure between 3–60 months

- Minimal documentation—often just PAN and Aadhaar

The Promissory Note Format India PDF serves as a reference for understanding what legal clauses may be included in such agreements.

| Important to Know: A promissory note is not a loan agreement, but a loan agreement can include a promissory note clause. |

Sample Outline of Promissory Note Format in India

Below is a simple, legally recognised structure that can be adapted for various loan transactions.

Date: [DD/MM/YYYY]

Place: [City, State]

I, [Borrower’s Full Name], residing at [Address], promise to pay [Lender’s Full Name], residing at [Address], the sum of ₹[Amount in figures] (Rupees [Amount in words]) with interest at the rate of [X]% per annum, repayable on [Due Date / On Demand].

Signed,

[Borrower’s Signature]

Witness 1: ___________

Witness 2: ___________

Why Use the Right Promissory Note Format India PDF?

Using the correct format:

- Ensures legal enforceability under Indian law

- Avoids disputes over repayment terms

- Clarifies obligations for both lender and borrower

- Simplifies court processes in case of default

| Facts to Know: Promissory notes in India are valid for 3 years from the date of execution. |

Final Word: Secure Your Loan with Confidence

A properly drafted promissory note protects both the lender and borrower, ensuring that loan transactions remain transparent and enforceable. Whether in physical or digital form, the Promissory Note Format India PDF provides a structured template for outlining repayment obligations.

For borrowers seeking quick, secure, and flexible financing, the personal loan offered by Airtel Finance is an excellent alternative, with transparent terms and minimal paperwork.

FAQs

Is stamp duty mandatory on promissory notes?

Yes, stamp duty is required under the Indian Stamp Act and state-specific rules.

Can a promissory note be handwritten?

Yes, it can be handwritten if all legal requirements and necessary details are included.

How long is a promissory note valid in India?

A promissory note remains legally enforceable for three years from its date of execution.

Can interest be charged on a promissory note?

Yes, the agreed rate must follow interest rules in words and figures.

Are witnesses required for a promissory note?

Witnesses are not mandatory, but their signatures strengthen the document’s validity and legal enforceability.