| Overview: Checking your PAN card status is a crucial step when applying for financial products such as personal loans or credit services. Each status message provides vital clues about your application’s progress and whether action is needed. Knowing what these messages signify helps prevent delays in your financial approvals. |

PAN Card Status Messages: The Hidden Clues Behind Your Application Progress

In India, your PAN card serves as a universal financial identity. It links all major financial activities, from salary credits to loan approvals. When you track your PAN card status, messages such as “Under Process,” “Dispatched,” or “Cancelled” indicate specific stages in verification.

According to the Income Tax Department, over 60 million PAN-related verifications occur annually through NSDL and UTIITSL. Delays or mismatched data can hold up crucial approvals such as personal loans or credit card applications. Understanding PAN card status can therefore save both time and opportunity.

What Different PAN Card Status Messages Mean

Each PAN card status message reflects a distinct stage in your application process, revealing whether it’s moving smoothly or needs immediate attention.

| Status Message | Meaning | What You Should Do |

| Application Received | PAN form submitted successfully and awaiting processing. | Wait 3–5 business days. |

| Under Process | Verification of documents ongoing. | No action needed unless delayed beyond 10 days. |

| Dispatched | PAN card printed and sent by post. | Track using courier details. |

| Objection Marked | Documents have discrepancies or are incomplete. | Re-upload documents online. |

| Cancelled | Application rejected due to invalid details. | Reapply with correct information. |

If your PAN card is delayed, you might face temporary hold-ups when applying for instant cash loans or other credit-based products.

How PAN Card Status Affects Loan and Credit Applications

When you apply for financial products, lenders verify your PAN details against government databases. Any issue in PAN card status can temporarily block credit checks or loan disbursals.

Here’s how PAN status impacts applications:

- Under Process: Loan approval may be delayed.

- Active: You are eligible for verification and processing.

- Cancelled: Lenders may reject your loan application until the issue is fixed.

- Objection Marked: Rejection is likely unless corrected quickly.

For example, while applying for an Airtel Finance Personal Loan, an active PAN card status helps your digital KYC verification go through instantly, speeding up approval and fund disbursal within minutes.

| Important to Know: PAN discrepancies can prevent personal loan approval even if your credit score and income are otherwise adequate. |

Role of PAN Card Status in Digital Loan Platforms

Fintech lenders like Airtel Finance rely heavily on digital KYC. During a personal loan request, PAN card status directly affects automated approvals.

- A valid PAN enables instant eKYC validation.

- Delayed or “Under Process” status halts instant approvals.

- Rectifying errors early supports smoother disbursal.

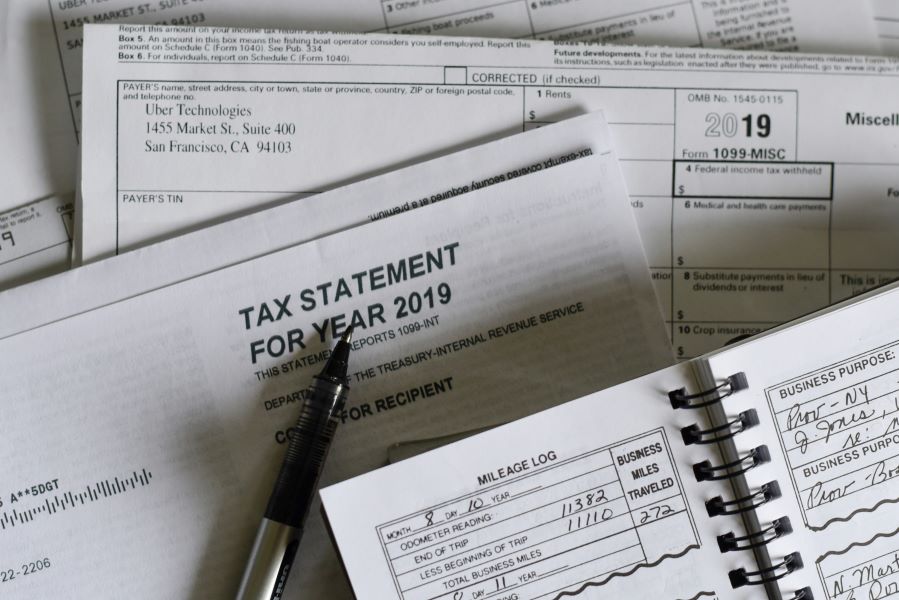

PAN Card Status and Error Resolution

If your PAN card status shows “Objection” or “Cancelled,” use the NSDL or UTIITSL portals to fix it. Typically, updates reflect within 5–7 working days. Always keep a digital copy of your PAN for verification during applications.

| Common Issue | Resolution Method |

| Mismatch in Name | Update via NSDL correction form. |

| Duplicate PAN | Request deactivation of older number. |

| Wrong Address | Apply for reissue with correct proof. |

| What You Must Know: PAN correction can be done entirely online, and no physical submission is needed for most applicants. |

Final Word: Why Your PAN Card Status Shapes Your Financial Journey

Your PAN card status is more than a technical detail. It determines the speed and success of your financial applications. Keeping your PAN “Active” avoids delays, rejections, and additional verification hurdles when seeking personal loans or credit.

For those wanting a seamless experience, Airtel Finance Personal Loan offers quick, paperless approvals backed by verified digital checks, using your PAN as the key identifier. The process takes just minutes on the Airtel Thanks app.

FAQs

1. What does “Under Process” mean in PAN card status?

It means your documents are still being verified by the authorities before final approval or dispatch.

2. Why is checking PAN card status important for loan applications?

It helps identify processing delays or document issues that might affect your loan approval and verification timelines.

3. How long does it take for PAN card status to update?

Usually, it takes around five to seven working days after submitting or correcting your PAN application.

4. What should I do if my PAN card status shows “Objection Marked”?

Recheck your submitted details, upload valid documents, and resubmit through the NSDL or UTIITSL portal immediately.

5. Can I apply for a loan if my PAN card status is “Under Process”?

It’s better to wait until your PAN status becomes active to avoid loan rejection or unnecessary verification delays.