Carbon Footprint Reduction: A Strategic Priority for Boardrooms in 2025

-

August 20, 2025

-

5 min read

Once a side project, carbon footprint reduction has swiftly evolved into a strategic boardroom priority in 2025. CFOs and top executives are now at the helm of climate initiatives, driving decarbonisation as a core business strategy. This transformation is driven by factors like:

- Heightened regulatory pressure, with frameworks like the EU’s Carbon Border Adjustment Mechanism (CBAM) and Corporate Sustainability Reporting Directive (CSRD) making emissions reduction non-negotiable

- Intensifying investor and stakeholder scrutiny demands transparency and action on environmental performance

- Direct business risks and opportunities linked to climate change, from extreme weather events to supply chain disruptions and evolving consumer expectations

This article examines the key factors driving carbon footprint reduction to the forefront of boardroom priorities. It also explores the strategies companies adopt and the role of digital technologies like Airtel IoT in enabling data-driven decarbonisation.

Regulatory Pressures: Compliance Is Non-Negotiable

Global regulatory frameworks are rapidly tightening, making decarbonisation a business imperative. The EU’s CBAM, now in its transitional phase, seeks to level the playing field on emission charges for carbon-intensive products. It will impact exports and imports across sectors like steel, aluminium, cement, and fertilisers.

Meanwhile, the CSRD extends carbon reporting requirements to thousands of SMEs, not just large corporations. This forces many more businesses to quantify and disclose their carbon footprint. In the US, binding climate disclosure laws in states like California keep the pressure on, even as federal incentives shift.

Non-compliance now brings not just reputational risk but also significant financial and operational threats:

- Exclusion from supply chains

- Hefty fines and penalties

- Loss of market access and competitive advantage

Boardrooms recognise that proactively reducing emissions is essential to navigating this complex regulatory landscape and maintaining their license to operate.

Investor Demands: Decarbonisation Drives Valuations

Investors embed Environmental, Social, and Governance (ESG) metrics into their decision-making processes. They reward climate leaders with better capital access, while penalising laggards with higher costs or divestment. Transparency on emissions and credible decarbonisation strategies now directly influence market valuation and access to sustainable finance.

Customers and B2B partners are also demanding low-carbon products and services. Sustainability credentials are now a key differentiator in both B2B and B2C procurement. Supply chain emissions, known as Scope 3, are under particular scrutiny. Multinational corporations require small suppliers to report and reduce emissions, pushing carbon accountability deeper into the business ecosystem.

Boards recognise that demonstrating authentic, measurable progress on carbon footprint reduction is important for brand reputation. It helps win customer loyalty and maintain a competitive advantage in an increasingly climate-conscious market.

Business Resilience: Climate Risk Is Business Risk

Physical climate risks, such as extreme weather events, droughts, and flooding, are now recognised as core enterprise risks. Transition risks, including policy changes, carbon pricing, and shifting customer behaviour, are also integral to risk management. In fact:

- 80% of S&P 500 companies and half of Russell 3000 companies publicly identify climate change as a business risk

- Many firms directly link climate risk to financial materiality and embed it into their risk management frameworks

- Board oversight of climate strategy is now seen as essential for long-term business continuity and resilience

Reducing emissions helps mitigate risks associated with supply chain disruptions, asset damage, rising insurance costs, and reputational harm from inaction. Boardrooms recognise that reducing carbon footprints is not merely an environmental necessity but also a fundamental risk management strategy.

Energy Efficiency Solutions: A First Step Towards Sustainable Change

As businesses embark on their decarbonisation journeys, energy efficiency solutions often emerge as the low-hanging fruit. Implementing measures like:

- Smart meters and real-time energy monitoring to identify wasteful patterns

- Building management systems to dynamically control HVAC, lighting, and other energy-intensive systems

- Industrial process optimisation through IoT and machine learning to reduce energy waste

These solutions can deliver significant emissions reductions while also cutting operational costs and improving business performance. For instance, IoT-enabled efficiency projects have documented 15-30% energy savings in commercial buildings and manufacturing operations, resulting in direct carbon reductions. Boardrooms prioritise energy efficiency investments as a win-win, offering both environmental impact and measurable economic benefits.

Harnessing IoT for Data-Driven Decarbonisation

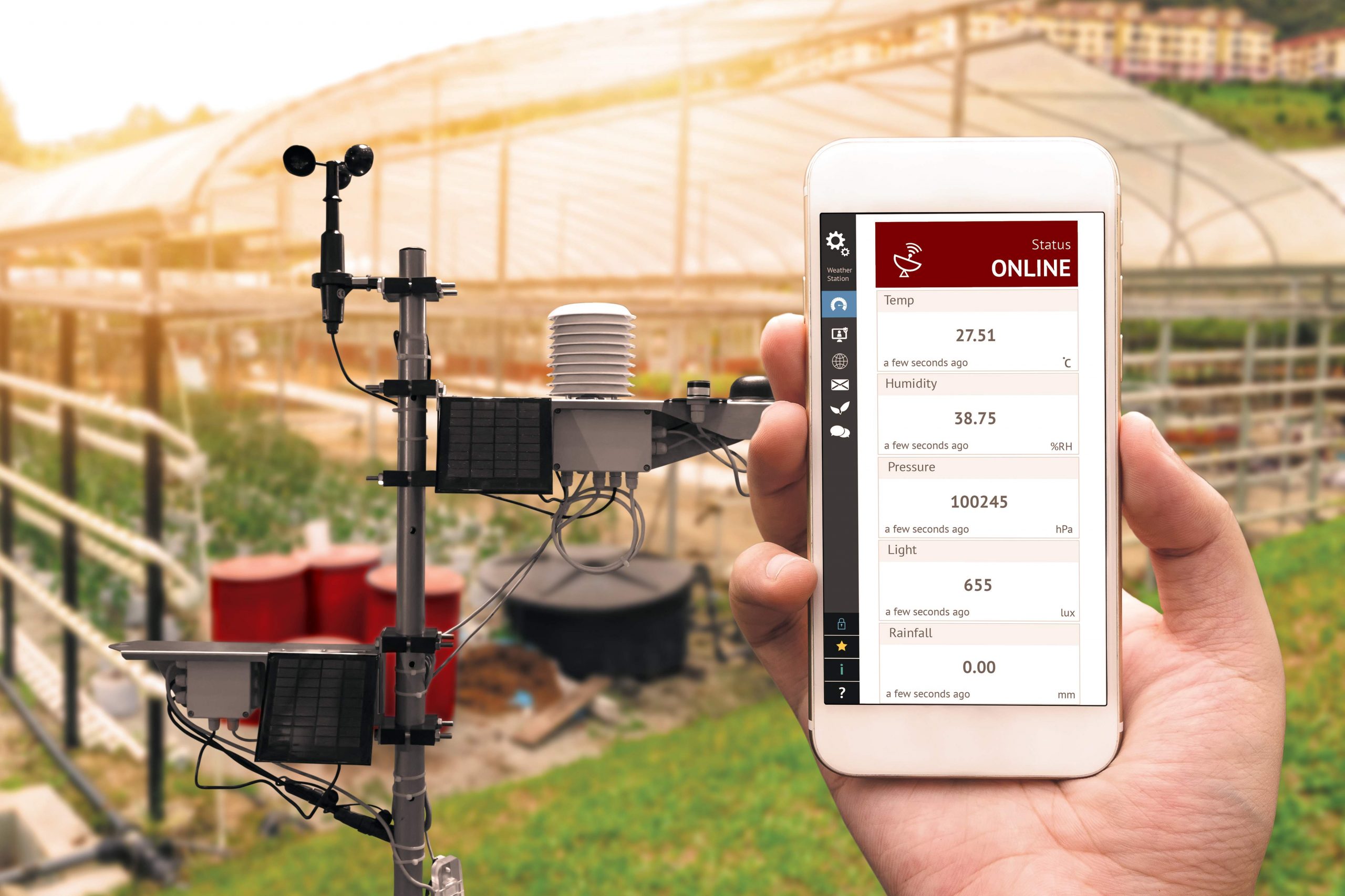

Digital technologies like the Internet of Things (IoT) are emerging as powerful enablers of carbon footprint reduction. IoT provides real-time, granular data on energy use and emissions across assets, facilities, and supply chains. This data underpins credible carbon accounting, reporting, and continuous improvement.

For example, IoT Smart Energy Management solutions from Airtel allow businesses to:

- Monitor equipment energy consumption, facility emissions, fleet fuel usage, and environmental parameters in real-time

- Calculate Scope 1, 2, and increasingly, Scope 3 emissions for comprehensive carbon accounting

- Identify high-impact areas for efficiency improvements and emission reduction

- Track progress against decarbonisation targets through real-time dashboards and analytics

By harnessing IoT data, boardrooms can make informed decisions on where to prioritise investments for maximum impact. They can also automate reporting for seamless compliance with evolving regulations. As reporting standards, investor expectations, and climate risks continue to rise, embedding IoT-powered carbon management into core strategy becomes a key differentiator.

Wrapping Up

Carbon footprint reduction is now a strategic imperative for boardrooms. It directly impacts regulatory compliance, investor relations, risk management, brand value, and competitive positioning. Boards are important in setting the tone, direction, and accountability for decarbonisation.

The solutions and strategies for enabling this transition are rapidly maturing, with energy efficiency, renewable power, circular models, and supply chain partnerships at the forefront. Underpinning these efforts are digital technologies like IoT, which provide the real-time data and intelligent controls needed for credible, auditable carbon reductions.

Embedding carbon footprint reduction into business strategy enables boardrooms to address the challenges of the net-zero economy. Digital technologies, like Airtel’s IoT Smart Energy Management, help seize new opportunities and navigate risks. In doing so, they contribute to a more sustainable world and build long-term business resilience and value.

Share

Share