| Overview: Aadhaar delivery delays can block your personal loan KYC process, affecting instant approvals. Learn how to track your Aadhaar status, explore alternative KYC options, and understand how digital lenders handle verification delays to maintain your personal loan eligibility. |

Why Aadhaar Delays Can Block Your Personal Loan Access

Most Indians expect instant personal loan approvals through digital platforms, but Aadhaar delivery delays can disrupt this seamless experience. With over 284 crore Aadhaar authentications conducted in January 2025 alone—a 32% yearly increase—the 12-digit identity system has become central to India’s financial ecosystem.

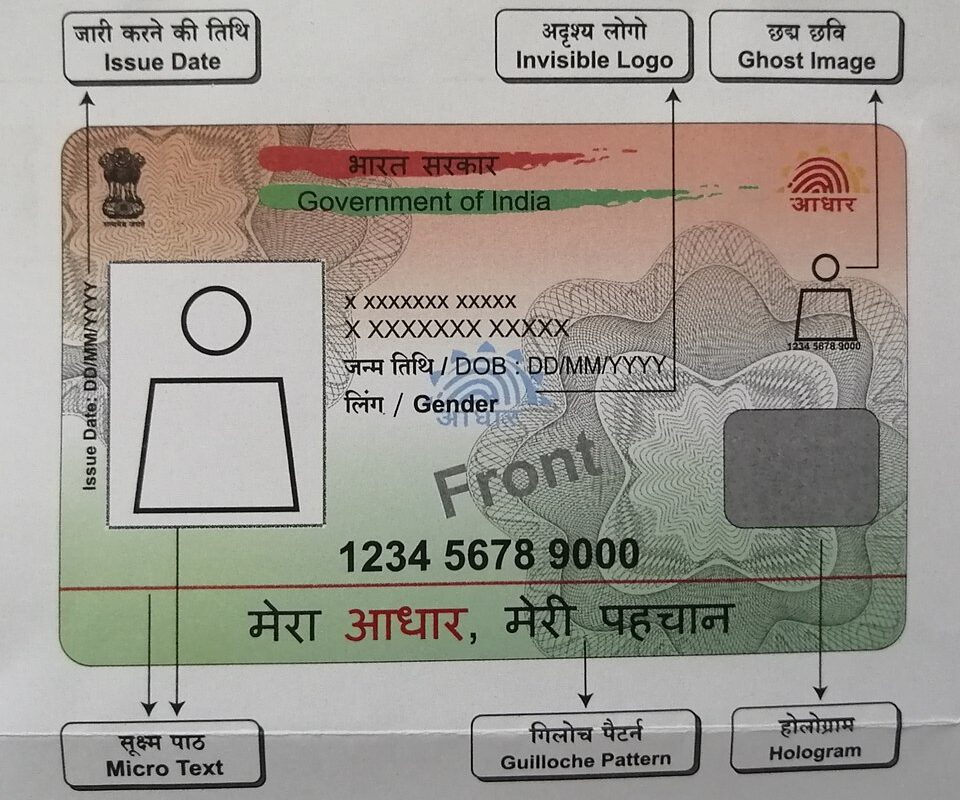

The Critical Role of Aadhaar in Personal Loan KYC

When your Aadhaar card doesn’t arrive on time, it can delay or block the eKYC process that lenders rely on for quick loan disbursals, potentially affecting your personal loan eligibility when you need funds most urgently.

Digital KYC Powers Instant Lending

Aadhaar-based eKYC has revolutionised personal loan processing in India. More than 43 crore Aadhaar eKYC transactions occurred in January 2025, highlighting its importance in banking and non-banking financial services.

For Airtel Finance Personal Loans up to ₹9,00,000, lenders can complete the entire approval process—from application to disbursal—within 24 hours when Aadhaar eKYC works smoothly. The system eliminates paperwork, reduces human error, and enables mobile-first lending that matches modern Indian consumers’ expectations.

Regulatory Framework Behind Aadhaar KYC

The Reserve Bank of India (RBI) mandates stringent KYC norms for all personal loan disbursals. Aadhaar serves as a single, comprehensive document that satisfies multiple KYC requirements simultaneously—proof of identity, address, and demographic verification.

How Aadhaar Delivery Delays Impact Your Finance Access

Aadhaar cards face delivery delays due to several factors:

- Postal service disruptions.

- Incorrect address details during enrollment.

- System errors at printing facilities.

- Logistical challenges in rural areas are causing extended delivery timelines beyond 90 days.

- Technical issues during enrollment (e.g., poor biometric capture).

- Incomplete documentation leading to re-enrollment requirements.

Real Impact on Personal Loan Applications

When your Aadhaar is delayed, lenders cannot complete eKYC verification, forcing them to either reject your application or request alternative documentation. Many digital lenders, including those offering instant loan services, have built their entire approval workflow around Aadhaar eKYC.

| Did You Know? If one Aadhaar enrollment packet fails a data check at the regional processing hub, the entire batch gets delayed—often affecting thousands of cards at the same time. |

How to Check Aadhaar Card Delivery Status and Find Alternatives

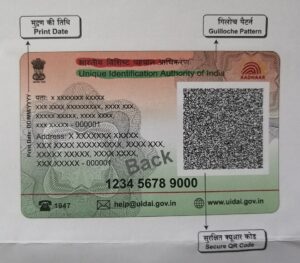

To check your Aadhaar card delivery status, visit the official UIDAI website and navigate to the ‘Check Aadhaar Status’ section.

Step-by-Step Status Tracking

- Keep your 14-digit enrollment ID and the registered mobile number ready.

- Visit the UIDAI status page to check real-time updates: under processing, printed, or dispatched.

- If the status shows ‘dispatched’ but the physical card hasn’t arrived within 15 days, file a complaint on the UIDAI portal or call their helpline.

- If you need it urgently, download your e-Aadhaar PDF, which is valid for most KYC and verification processes.

Alternative KYC Options for Personal Loans

When Aadhaar delivery is delayed, several alternative documents can help maintain your personal loan eligibility:

- PAN Card + Address Proof: Combines identity and address verification.

- Voter ID: Serves as both identity and address proof for many lenders.

- Passport: Premium identity document accepted universally.

- Driving License: Valid identity proof with address details.

While these alternatives work, they require manual verification, extending processing time from instant approval to 2-3 business days.

Managing Your Financial Access During Delays

While waiting for Aadhaar delivery, focus on strengthening other aspects of your personal loan eligibility. Maintain a stable income source, keep existing EMIs current, and monitor your credit score regularly. These factors remain crucial regardless of the KYC method used.

Consider applying with lenders such as Airtel Finance, who explicitly support alternative KYC methods if your financial need is urgent. However, be prepared for potentially longer processing times and additional documentation requirements. The key is balancing speed requirements with available options based on your specific situation and timeline.

FAQs

1. What is Aadhaar-based eKYC and why is it essential for personal loans?

Aadhaar eKYC digitally verifies your identity using biometrics and demographic data, enabling instant, paperless personal loan approvals without physical document submission.

2. How do I check the Aadhaar card delivery status if it’s delayed?

Visit the UIDAI website, and enter your 14-digit enrollment ID and registered mobile number to track real-time delivery status and estimated arrival dates.

3. Can I get a personal loan without Aadhaar if delivery is delayed?

Yes, lenders accept alternative KYC documents like PAN card, voter ID, or passport, though processing may take longer than Aadhaar-based instant approvals.

4. How long does personal loan approval take without Aadhaar eKYC?

Without Aadhaar, personal loan eligibility verification takes 2-3 business days versus instant approval with eKYC, depending on document verification complexity.

5. What should I do if my Aadhaar shows ‘dispatched’ but hasn’t arrived?

Contact the UIDAI helpline or file an online complaint if your card doesn’t arrive within 15 days of dispatch status, and consider downloading e-Aadhaar for immediate use.