Are you self-employed and in need of a personal loan, but don’t have traditional income proof? Getting a loan without a job or income verification can seem daunting. However, there are loan options available even if you can’t provide salary slips or bank statements. You can download the Airtel Thanks App to find out all the information about personal loans offered by Airtal Finance. In this article, we’ll explore how to get a personal loan without income proof, the types of loans available, eligibility criteria, and tips for a successful application.

Understanding Personal Loans Without Income Proof

What are no income verification loans?

No income verification loans, also known as loans without income proof, are personal loans that don’t require traditional income documents like salary slips or ITR. Instead, lenders assess your creditworthiness based on alternative factors such as your credit score, business revenue, and bank statements.

Who can apply for personal loans without income proof?

These loans are primarily designed for self-employed individuals, freelancers, and small business owners who may not have a steady salary or traditional income proof. If you fall into one of these categories and need funds for personal or business expenses, a no income proof loan could be a viable option.

Types of Personal Loans Without Income Verification

-

Unsecured personal loans

Unsecured personal loans don’t require any collateral and are based on your creditworthiness. Lenders assess factors like your credit score, business revenue, and bank statements to determine your eligibility and loan amount. -

Secured personal loans

With secured personal loans, you provide an asset as collateral, such as a fixed deposit, property, or vehicle. This reduces the risk for lenders and may help you secure a lower interest rate. For example, you can get a loan against your FD with Airtel Finance. -

Peer-to-peer loans

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders. These loans often have more flexible eligibility criteria and may be open to self-employed individuals without traditional income proof.

Eligibility Criteria for No Income Proof Loans

While specific requirements vary by lender, here are some general eligibility criteria for personal loans without income verification:

-

Age: 21-65 years

-

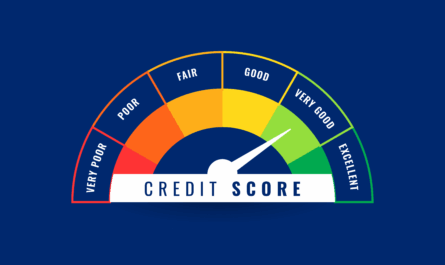

Credit score: 650 or above

-

Business vintage: Minimum 2-3 years

-

Annual business revenue: ₹5 lakh or more

-

Bank statements: Steady cash flow for 6-12 months

Check your eligibility for a personal loan with Airtel Finance.

Documents Required for Personal Loans Without Income Proof

Although you may not need to provide traditional income proof, lenders will still require certain documents to assess your creditworthiness:

-

KYC documents (PAN card, Aadhaar card, etc.)

-

Bank statements for the past 6-12 months

-

GST returns or other business-related documents

-

Proof of business ownership and vintage

See the full list of documents required by Airtel Finance.

Tips for Getting a Personal Loan Without Income Verification

-

Maintain a good credit score

Your credit score is a crucial factor in getting approved for a loan without income proof. Aim for a score of 750 or above by paying your bills on time, keeping your credit utilization low, and avoiding multiple loan inquiries. Check your credit score for free with Airtel Finance. -

Show steady business revenue

Lenders want to see that your business generates consistent revenue. Maintain steady cash flow in your bank accounts for at least 6-12 months before applying for a loan. -

Provide collateral

Offering an asset as collateral can increase your chances of approval and help you secure better loan terms. Consider pledging a fixed deposit, property, or vehicle to reduce the lender’s risk. -

Compare loan offers

Interest rates on personal loans without income verification may be higher than traditional loans. Compare offers from multiple lenders, including banks, NBFCs, and P2P platforms, to find the most competitive rates and terms. Check the interest rates offered by Airtel Finance.

In conclusion, getting a personal loan without income verification is possible for self-employed individuals and freelancers. By understanding the types of loans available, eligibility criteria, and required documents, you can increase your chances of approval. Maintain a good credit score, show steady business revenue, and compare loan offers to find the best option for your needs. Apply for a personal loan with Airtel Finance today and get the funds you need to grow your business or meet personal expenses.

FAQs

-

What is a personal loan with no income verification?

A personal loan with no income verification is a loan that doesn’t require traditional income proof like salary slips or ITR. Lenders assess your creditworthiness based on alternative factors. -

Can I really get a personal loan without providing proof of income?

Yes, there are loan options available for self-employed individuals and freelancers who may not have traditional income proof. Lenders consider factors like credit score and business revenue instead. -

Are interest rates higher on loans without income verification?

Interest rates on no income proof loans may be slightly higher than traditional personal loans due to the increased risk for lenders. However, maintaining a good credit score and providing collateral can help secure better rates. -

Can I get a personal loan with no income verification if I have bad credit?

Getting a personal loan without income proof and with a low credit score can be challenging. Work on improving your credit score and consider secured loan options to increase your chances of approval.