AT BHARTI AIRTEL, WE HAVE THRIVED GLOBALLY BY EXPLORING POTENTIAL MARKETS, ADAPTING NEW TECHNOLOGIES AND ENTERING INTO STRATEGIC PARTNERSHIPS. NEW INITIATIVES OPEN UP NEW POSSIBILITIES BUT BRING ALONG WITH THEM POTENTIAL RISKS AND UNCERTAINTIES.

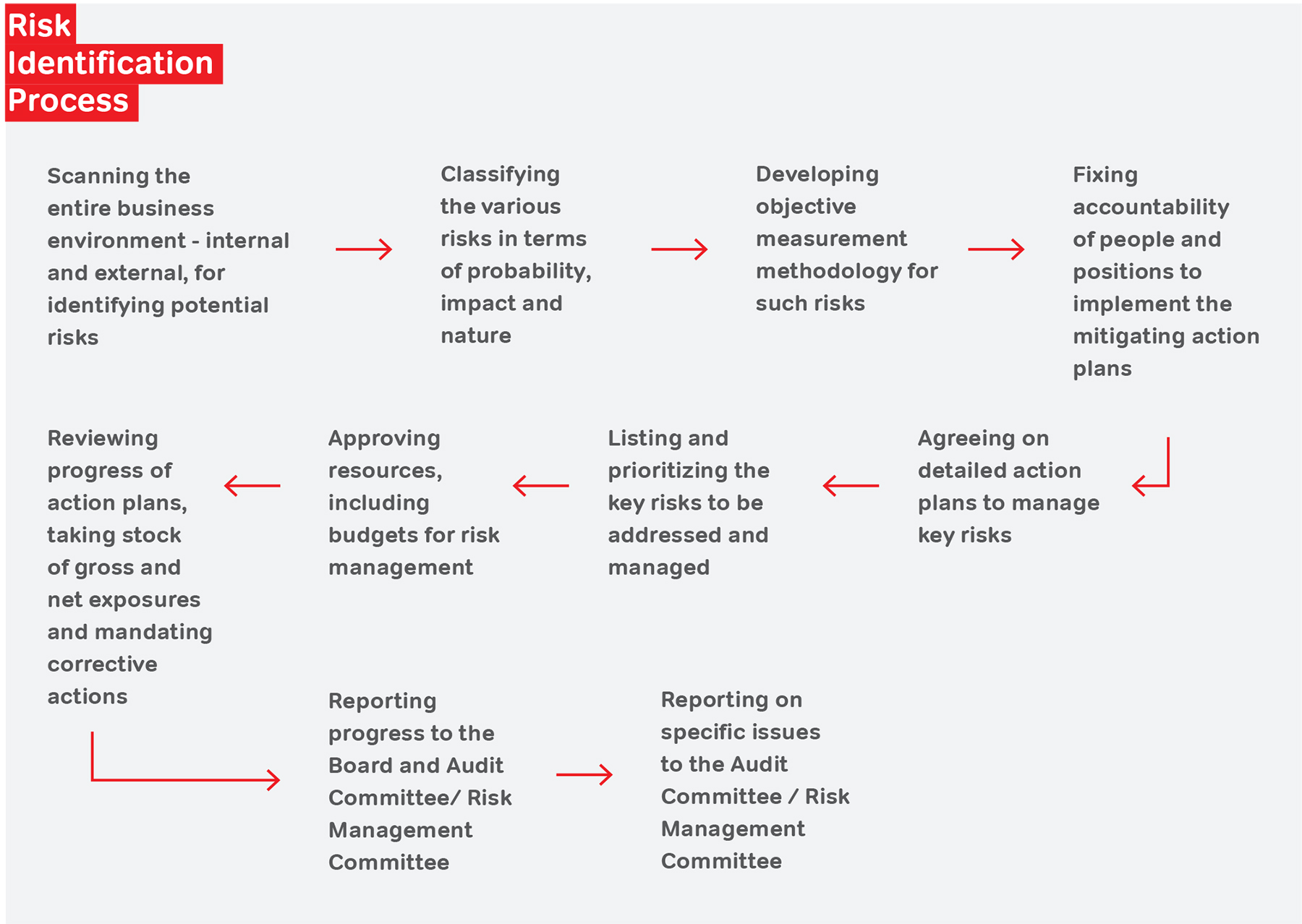

At Airtel, the Board and leadership team work tirelessly to mitigate possible risks that bring along potential disruption in smooth business operations. This explains our creation of a robust risk management framework that caters to strategic, legal, financial, operational and climate risks.

At the Board Governance level,

the Risk Management Framework is evaluated frequently by the Company’s Risk Management Committee. An annual evaluation is also done by the Board of Directors. These apex reviews include: discussions on the management submissions on risks, identifying crucial risks and approving relevant action plans to mitigate such risks on priority. The responsibility of assisting the Risk Management Committee on independent basis lies with the Internal Audit function armed with full status of risk assessments and management. Acquiring frequent updates on certain identified risks, depending upon the nature, quantum and the likely impact on the business is also the Risk Management Committee's job.

At the Management level,

the respective CEOs for the Management Boards (AMB and Africa Exco) are responsible for managing risks across their respective businesses, viz., India & South Asia, and Africa. The strategic risk registers capture the risks identified by the operating teams (Circles or Operating Companies) as well as the functional leadership teams at the national level. The AMB / Africa Exco ensure that the environment – both external and internal – is scanned for all possible risks. Internal Audit reports are also considered for the identification of key risks.

At the Operating level,

the Executive Committees (EC) of Circles in India and Operating Companies in the international operations are entrusted with responsibilities of managing the risks at the ground level. Every EC has local representation from all functions, including many centrally driven functions like Finance, SCM, Legal & Regulatory besides customer facing functions, such as Customer Service, Sales & Distribution and Networks. It is the responsibility of the Circle CEO or Country MD to pull together various functions and partners to manage the risks. They are also responsible for identification of risks, and escalating it to the Centre for agreeing on mitigation plans. Operating level risk assessments have been concluded at Function/ OpCo risk assessment and mitigation plans have been agreed upon.

Internal Audit Plans are being drawn up to ensure scope and coverage of these critical risks during the course of next year.

The key risks that may impact the Company are:

Potential Risks |

Risk definition |

|---|---|

|

Volatile and uncertainty in macro-environment with geo-political tensions in India, Sri Lanka and 14 African countries. |

|

Business operations might be impacted with instability in economies in our countries of operations with factors like inflation, interest rates, capital controls and currency fluctuations. |

|

Risks in network infrastructure cost due to technical failures, human errors and natural disasters. Dynamic changes in IT landscape require constant upgradation of technologies. |

|

Unprecedented disruption and unfair pricing may lead to competition and may erode revenue with loss of customers. Further the evolving customer expectations in terms of quality, variety, features and pricing pose threat to business sustainability. |

|

Risk of data loss can lead to accidental exposure of confidential information across all endpoint devices. |

|

Increase in business operation expenses (new sites rollouts, capacity) and/or rate increases (inflation, Fx impact, wage, hikes, energy, etc.) |

|

Telecom companies are required to invest in innovation to match with changes in industrial landscape to provide high quality customer experience and meet the increased customer demand for a stronger and better network connectivity |

|

Any gaps in internal controls and / or process compliances not only lead to wastages, frauds and losses, but can also adversely impact the Airtel brand. |

|

Rapid technology evolution may impact the business functionality and lead to slowdown in business. |

|

Increasing carbon footprint is a serious concern which raises questions on business credibility and sustenance in the long-term. |