Low Joining Fees

Just ₹500 joining fees

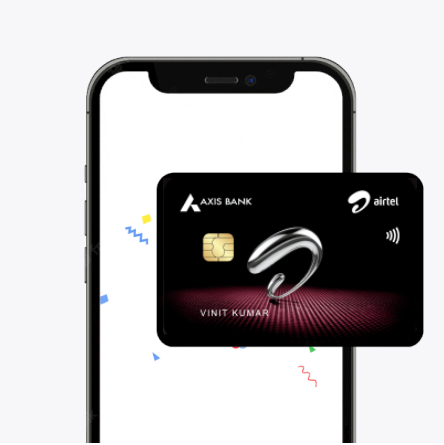

Get Credit Limit up ₹5 Lakhs ✔️₹500 Amazon Voucher

Apply Now

Apply for your feature-rich Credit Card in Delhi using the Airtel Thanks app! Now you have a chance to save big every time you use the credit card and make annual savings worth up to Rs 16,000. Get loads of added benefits such as airport lounge benefits, cashback offers and discounts on bill payments, a greater credit limit, and much more.

Easily calculate your monthly EMIs for credit card purchases with Airtel Finance. Enter the amount, tenure, and interest rate to get instant estimates.

Managing your daily expenses becomes much easier with a Credit Card in Mumbai. Keep a clear track of where you spend, and how much you spend, and get additional rewards too. A Credit Card will also help you get extra benefits such as airport lounge access, cashback offers, and multiple discounts.

Big savings and cashback offers, now with credit card

Just ₹500 joining fees

Up to ₹5 lakh credit

Save up to ₹16,000 annually

Just ₹500 as annual fee

Apply on the Thanks app

18-70 years old

Applying for a credit card is very easy. Follow the steps below:

Download the app and go to Shop section

You will see the Credit Card button

Now fill up the complete application form

The card will be delivered to you within 5-7 business days.

Fulfill these eligibility criteria to get the credit card!

Individual should be a Resident of India

The age of the primary cardholder should range between 18 and 70 years.

PAN card or Form 60, Residential, Identity, and Income proof, Colour Photograph

Getting your brand new feature-rich credit card in Mumbai is now extremely simple. Just apply for a Credit Card from the Airtel Finance and make big savings, whenever you pay using your credit card. What is even more lucrative is that you stand the chance to save up to ₹16,000 each year, by using this credit card.

Added features of the Credit Card in Mumbai include airport lounge benefits, cashback offers on recharges done via the Airtel Thanks app, discounts at partner restaurants, fuel surcharge waiver and a lot more.

10% cashback on food & groceries, 25% on Airtel bills, and high card limit up to ₹5,00,000. Bonus: Get ₹500 Amazon voucher after first use.