Get Credit Limit up ₹5 Lakhs ✔️₹500 Amazon Voucher

Apply Now

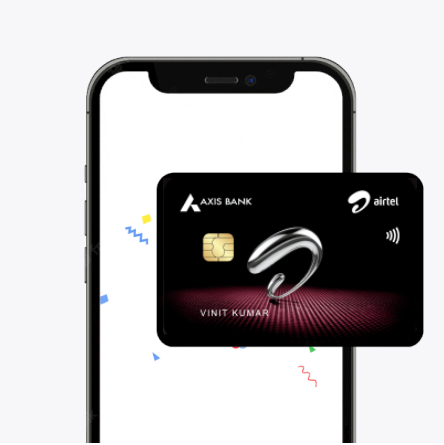

The Airtel Axis Bank Credit Card is a co-branded product from Airtel and Axis Bank. It is designed to provide practical savings for Airtel users and individuals who spend regularly on essentials. The card offers cashback on Airtel recharges, utility bill payments, food delivery, groceries, and other daily transactions.

With a credit limit of up to ₹5 lakh, it also supports higher spending needs. It serves as a cost-effective credit card option with simple eligibility requirements and a straightforward application process. Customers can apply for the Airtel Axis Bank Credit Card directly through the Airtel app, making it convenient to access benefits and manage payments digitally.

Easily calculate your monthly EMIs for credit card purchases with Airtel Finance. Enter the amount, tenure, and interest rate to get instant estimates.

The Airtel Axis Bank Credit Card is structured to provide direct financial benefits on essential and lifestyle expenses. Key highlights include:

These Airtel Axis Bank Credit Card features are designed to make the card an efficient choice for individuals seeking cashback, discounts, and reward accumulation on frequent transactions.

The Airtel Axis Bank Credit Card is designed to deliver value across multiple spending categories, combining savings with lifestyle advantages. Look at the top Airtel Axis Bank Credit Card benefits:

Cardholders receive 25% cashback on Airtel services, including prepaid and postpaid mobile, broadband, DTH, and Wi-Fi bills. This makes the card particularly effective for Airtel customers who rely on these recurring services.

The card extends 10% cashback on electricity, gas, and water bill payments, along with benefits on food delivery and grocery platforms such as Swiggy, Zomato, and BigBasket. In addition, discounts on OTT subscriptions provide access to entertainment at lower costs.

Domestic airport lounge access is available up to four times a year, offering comfort and convenience during travel. The card also provides a 1% fuel surcharge waiver across fuel stations in India, making it a practical choice for frequent commuters.

The joining fee and annual fee are both set at ₹500, with the annual fee waived from the second year if annual spends exceed ₹2 lakh. Alongside the structured cashback, customers also earn 1% cashback on all other spends, ensuring value across every purchase.

The Airtel Axis Bank Credit Card has a joining fee of ₹500 and an annual fee of ₹500, which is waived from the second year if annual spends exceed ₹2 lakh. The renewal fee is the same as the annual fee. Interest is charged on outstanding balances at Axis Bank’s standard credit card rates, and late payment fees are applied based on the total amount due. The Airtel Axis Bank Credit Card charges remain structured and transparent for users.

To apply for the Airtel Axis Bank Credit Card, applicants must meet the following criteria:

Applicants can also check their Airtel Axis Bank Credit Card eligibility in advance using the eligibility calculator provided by Airtel Finance before applying through the Airtel app.

To complete the application for the Airtel Axis Bank Credit Card, applicants must provide the following:

Submission of these Airtel Axis Bank Credit Card documents is mandatory to verify eligibility and ensure smooth card issuance.

To apply for an Airtel Axis Bank credit card, the process is entirely digital and simple:

Before applying, it is important to understand the key requirements and conditions associated with the Airtel Axis Bank Credit Card. Reviewing these points ensures a smooth application and effective usage of the card.

10% cashback on food & groceries, 25% on Airtel bills, and high card limit up to ₹5,00,000. Bonus: Get ₹500 Amazon voucher after first use.