Partner Restaurants

Up to 15% off

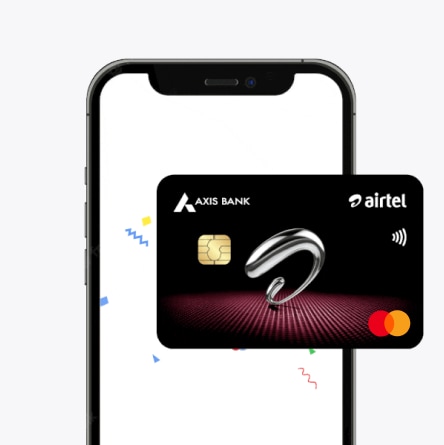

Get Credit Limit up ₹5 Lakhs ✔️₹500 Amazon Voucher

Apply Now

A corporate credit card is a type of credit card issued to employees of a company for business-related expenses. These cards are typically used to streamline and manage corporate spending, such as travel, entertainment, office supplies, and other operational costs.

Easily calculate your monthly EMIs for credit card purchases with Airtel Finance. Enter the amount, tenure, and interest rate to get instant estimates.

All You Need To Know About Corporate Credit Cards With Airtel

Up to 25% cashback

Up to 10% Cashback

Up to 10% Cashback

Up to 1% Cashback

Enjoy Additional Benefits With Your Corporate Credit Card

Up to 15% off

Up to 1% waiver

Access up to 4 times/year

Between 18 years to 70 years

Applicant should have an Indian citizen

Identity proof, address proof, etc

A corporate credit card offers numerous benefits to businesses, enhancing financial management, convenience, and efficiency. One of the primary advantages is streamlined expense tracking. With a corporate credit card, all business-related expenditures are consolidated into a single account, making it easier to monitor, analyze, and manage expenses. This leads to improved budgeting and financial planning, as well as simplified accounting processes.

Corporate credit cards also offer enhanced control over employee spending. Businesses can set spending limits for individual cardholders, restrict certain types of purchases, and receive detailed transaction reports. This reduces the risk of unauthorized or excessive spending, ensuring that funds are used appropriately.

Additionally, corporate credit cards often come with valuable rewards and benefits. These can include cashback on purchases, travel rewards, discounts on business services, and complimentary insurance coverage such as travel and purchase protection. These perks can significantly offset business expenses and add value to the company’s overall financial strategy.

Another key benefit is improved cash flow management. Corporate credit cards provide a grace period between the purchase and the payment due date, allowing businesses to manage their cash flow more effectively. This is particularly useful for maintaining liquidity and covering short-term expenses without immediately impacting the company’s cash reserves.

Overall, corporate credit cards are essential tools for modern businesses, offering financial control, convenience, and valuable rewards.

| Credit Cards | Joining Fees | Rewards & Benefits |

| Airtel Axis Bank Credit Card | ₹500 | Enjoy high credit limit, amazing discounts, and offers associated with your business transactions. |

| HDFC Bank Business MoneyBack Credit Card | ₹500 | Earn 5% cashback on business essentials like Utility, Telecom, Govt and tax, 5x Reward points on fuel, 2500 bonus reward points on annual spending of ₹ 1,80,000, and more. |

| CSC Small Business MoneyBack Card | ₹250 | Get 5% cashback on business essentials like Utility, Telecom, Govt and tax. on minimum monthly spends of ₹10K, 1000 bonus reward points on annual spends of ₹ 90,000, and more. |

10% cashback on food & groceries, 25% on Airtel bills, and high card limit up to ₹5,00,000. Bonus: Get ₹500 Amazon voucher after first use.