Higher credit limit

Credit limit up to ₹5 lacs

Get Credit Limit up ₹5 Lakhs ✔️₹500 Amazon Voucher

Apply Now

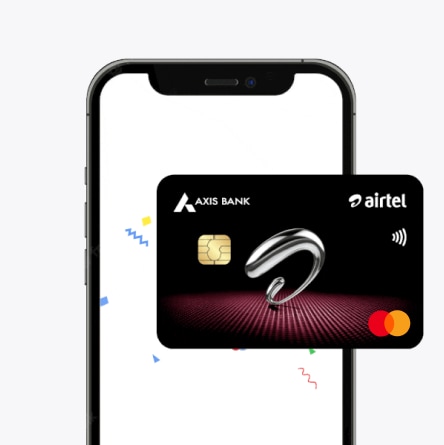

A credit card gives you the power to save big with annual cashbacks and plenty of rewards. Get amazing offers across multiple categories – lifestyle, travel, shopping, and more. Complete a simple application process on the Airtel Thanks app and get ready to step into a world of hassle-free payments.

Choose this credit card as it offers annual cashbacks of up

to ₹16,000. You also get a host of welcome benefits, rewards,

dining delights and complimentary lounge access. All of this

with low joining fees.

Big savings and cashback offers, now with Credit Card

Credit limit up to ₹5 lacs

Save up to ₹16,000

Pay low joining fees

Just ₹500 as annual fee

Apply on the Thanks app

18-70 years old can apply

Experience a privileged lifestyle with a credit card

Paid via Airtel Thanks

Zomato, bigbasket, Swiggy

Utility bills via Thanks

On all other spends

4x lounge access/year

1% fuel surcharge waiver

Applying for a credit card is easy. Follow the steps below:

Download the app and go to Shop section

Click on the credit card banner

Now fill up the complete application form

The card will be delivered to you very soon

Fulfill these eligibility criteria to get the Credit Card!

The credit card applicant must be an Indian resident or a non-resident Indian.

Age of the primary cardholder should range between 18 and 70 years.

PAN card or Form 60, Residential, Identity, and Income proof, Colour Photograph

A credit card is issued to you by a merchant that enables you to make purchases or transactions with the help of credit. The credit card works on the concept that you will have to pay back your credit card bill after a certain amount of time.

To apply for your credit card via the Airtel Thanks App, install the app through PlayStore or App Store, if you haven’t. In the app, navigate to the ‘shop’ category, then choose ‘credit card’ under ‘Financial Services’. Provide the required information and your card will be delivered to you.

Yes, indeed! Non-Airtel users can very well apply for a credit card from Airtel Finance if they are eligible.

The total credit limit on a credit card varies from one person to another. However, if you have a good credit score and pay all your EMIs on time, then you will be able to enjoy a greater credit limit.

The actual interest rate on a credit card depends on a lot of factors – whether you have missed out on payments, which merchant you are using and many more. To make sure you do not have to pay credit card interest rates , you should try to pay your credit card bills on time. Additionally, make sure you are paying back the complete amount and not the minimum amount payable.

Making payments with the credit card is an effortless process. Simply visit any e-commerce website and instead of selecting your debit card, make the payment with your credit card.

Yes, you can get airport lounge benefits with specific credit cards.

Ideally, it is always advised that you never miss a payment on your credit card. However, if such a situation arises, you will be charged a penalty and that is never an ideal scenario. Such penalties can be heavy on the pocket, so the best solution is to clear your dues on time.

In case you need to raise a dispute for your credit card, then it is advisable to get in touch with your credit card merchant. You will find their customer support number from the main website, with a few clicks.

You can certainly use your credit card internationally. In fact, an international credit card could be one of the safest methods of making payments, when you are travelling abroad. Furthermore, it also provides you with the flexibility of travelling cash-free.

You should never divulge your credit card information to anyone. In addition, it is advised that you never click on spurious links or share your credit card OTP with anyone over calls or messages. One of the best ways to keep your credit card information safe and secure is to keep your details conifdential.

There are plenty of benefits associated with a credit card. For instance, the Credit Card provides a broad range of cashback offers, recharge benefits, airport lounge, fuel surcharge waivers, low joining fees, and lots more. It is the perfect credit card for you, if you are looking for a credit card full of benefits.

For the complete terms and conditions associated with Credit Cards, you can click here.

To cancel or block your credit card, simply get in touch with your credit card merchant and inform them that you would like to cancel your credit card. Make sure that all your pending credit card bills are paid before you proceed to cancel the card.

It is difficult to obtain a credit card for yourself when your credit score is not up to the mark. However, it is not impossible, and some merchants might offer you a credit card. Regardless, the credit limit might be low in such cases.

You can track your credit card transactions with the help of credit card statements. These statements will be mailed to your registered email ID after every credit card cycle. Additionally, you can also track it from the credit card merchant’s website.

Reward points are extra points that you get after you complete a transaction on your credit card. The more the value of the transaction, the higher the reward point. To redeem your reward points, you can visit the merchant’s website and look at the products/services on which you can redeem your reward points.

The credit card statement is an important document that has all the details of the transactions that you make on the credit card. The credit card statement contains information about your purchases, your credit balance, the minimum amount payable, and more. It is issued after every credit card cycle ends.

The credit card balance is the total amount of credit that has been lent to you by the merchant. How you use this credit card balance depends totally on you.

In case, your credit card gets lost or stolen, then you should proceed to block it immediately. Get in touch with the customer support team of your credit card and provide all the necessary information needed to get the card cancelled.

If you have a Credit Card, then you can get cashback worth up to 25% on Airtel prepaid, postpaid, broadband, and DTH bill payments when you use the Airtel Thanks app.

Yes, non-Airtel users can also apply for the Credit Card and reap its many rewards and benefits.

The minimum due on a credit card refers to the minimum amount that you must pay so that you can enjoy the facilities of your credit card. It is only a small fraction of the total outstanding amount that you are yet to pay.

A credit card is a card that is issued by a bank and acts as a line of credit from the bank itself. The user of a credit card is provided with a pre-specified credit limit, which can be used to make purchases, pay bills, and more.

Using credit on the credit card means that the user has to pay the amount at a later stage, once the credit card cycle is completed. The user can choose to pay the entire outstanding balance at once or pay the minimum amount due on the credit card and accrue credit card interest rates on the remaining balance.